An analysis is currently circulating on social media comparing Bitcoin’s current price trajectory to that of ten years ago. The comparison suggests the cryptocurrency might once again be in a phase that could lead to a significant price surge. Is Bitcoin on the verge of closing out the year with much higher prices?

The Bitcoin Analysis #

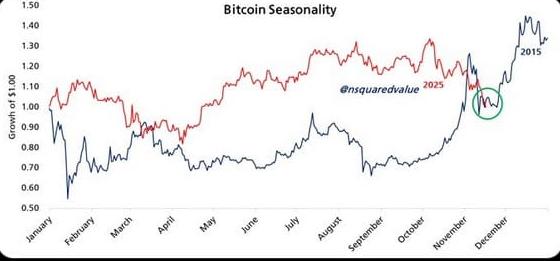

The comparison comes from market analyst Timothy Peterson, who shared a chart from 2015 on platform X. It shows how Bitcoin first experienced a sharp drop, followed by a rapid recovery. Within about a month, the price rose by approximately 45% during that period. Peterson has plotted this price movement against Bitcoin’s recent development, noting similarities between the two patterns.

The price of bitcoin, compared to now (red line). Source: Timothy Peterson / X.

In early December 2015, Bitcoin was trading at around $380. In the weeks that followed, it climbed to about $540, before closing the year near $430. This period occurred two years after the major bull market of 2013 and the subsequent crash. Moreover, the market was then in the run-up to the so-called halving in 2016, when the reward for miners is halved.

Different Situations #

That context is crucial for the comparison Peterson is making with the current situation. Whereas 2015 was the period before a halving, the market is now in the phase after one. Within the much-discussed Bitcoin cycle, these periods are typically characterized differently.

According to this theory, a halving is usually followed by a phase of price increases, then a peak, and eventually a prolonged correction. Subsequently, a period of relative calm emerges, allowing investors to position themselves in anticipation of the next halving.

This means the circumstances of then and now are fundamentally different, at least if this cycle is still used as a guide. Nevertheless, investors continue to analyze charts in search of recognizable patterns that might say something about future price movements.

Criticism: A Distorted Picture #

Critics point out that statistical comparisons are often used selectively. As is often said: statistics can provide insights, but also paint a distorted picture. Furthermore, the Bitcoin market has changed significantly in ten years. Think of the introduction of exchange-traded funds (ETFs), institutional investors, changes in interest rate policy, and Bitcoin’s significantly larger market capitalization.

Although parallels with 2015 may be interesting, they offer no guarantee of a repeat. Similarities from the past say little about future performance. This also applies to the rest of 2025 and the years that follow.