What will the price do? According to some analysts, key technical indicators suggest that the bear market has begun. Others, however, see hopeful signals, as the profitability of miners has dropped to levels that typically precede a continuation of the uptrend. Read more about the predictions below.

Has the Bitcoin Bear Market Started? #

Has the bear market started? According to analyst Crypto₿irb, technical analysis points to it. He writes that it appears Bitcoin is not undergoing a price correction, but rather a persistent downward trend. He states:

“From a technical standpoint, the bull market is over.”

He points to several indicators that have turned negative. The price has fallen too much in percentage terms, trading volume has risen too sharply, volatility is too high, and there is insufficient market breadth.

Additionally, the price remained below the 200-day moving average for too long, resulting in a ‘death cross’ on the chart.

According to Crypto₿irb, this combination indicates that it is not a temporary correction, but that we can expect further price declines in the coming year:

“In 2026, look down.”

“A trend and not a correction. From a technical standpoint, the bull market is over. #Bitcoin sees a persistent trend shift confirmed by price percentage traveled, volume spikes, above-the-average volatility, time below the 200-day trend, and worsened breadth. In 2026, look… https://t.co/2GQDA4zxRJ pic.twitter.com/p18pwEf3UT”

— CRYPTO₿IRB (@crypto_birb) November 27, 2025

Or Is It Still a Bull Market? #

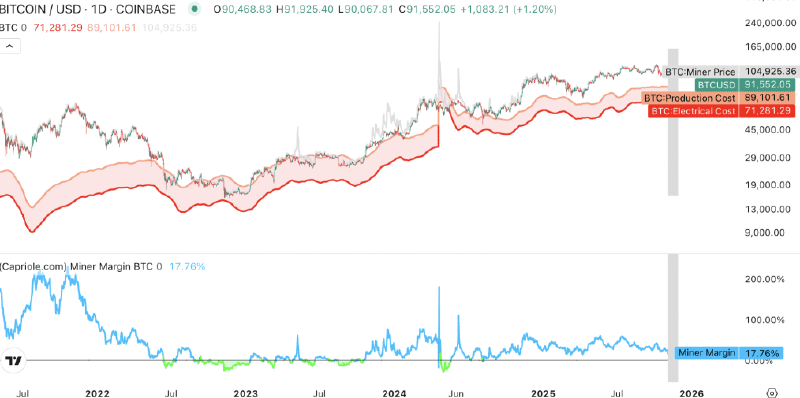

Others, however, see hopeful signals, especially in the mining sector. Due to the price drop, bitcoin mining is currently barely profitable, as the bitcoin price hovers just above the average production cost per bitcoin.

The profit margin for miners is currently only 2 to 3 percent, one of the lowest levels of this cycle.

Although that seems like a negative signal, such levels have historically led to decreasing selling pressure. Miners that are too inefficient and therefore no longer profitable are forced to stop mining due to the low price.

This results in a decrease in mining difficulty, which in turn increases the profitability of the remaining miners and allows the market to recover steadily.

The Dynamic Range Network Value (NVT) indicator also gives hope. This indicator weighs the value of the entire network against the value of the transactions. Currently, the NVT is at levels that are usually only reached just before a price bottom is found.

The AI trading bot of Capriole Investments has therefore switched to ‘cautiously optimistic’ for the first time in a while.