When bitcoin takes a sharp dive, investor sentiment quickly plummets. That’s understandable: everyone prefers to see prices rise. But during a significant drop, even the most vocal crypto advocates make their voices heard, and this time was no different.

Tom Lee Points to Technical Error #

Tom Lee, director of Bitmine, analyzed the events surrounding the crash on October 10. In an appearance on CNBC’s Power Lunch, he linked the decline in bitcoin to a technical issue in the price feed of the stablecoin USDe.

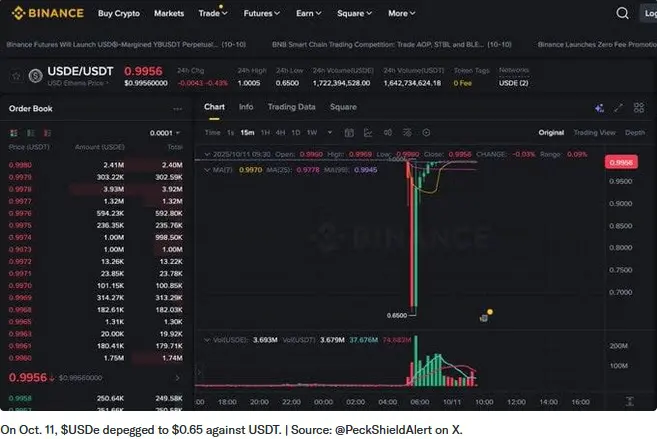

On crypto exchange Binance, the price of USDe suddenly deviated sharply from other exchanges. The stablecoin, which should normally remain stable at one dollar, plummeted to $0.65 on October 11. This deviation had major consequences.

According to Lee, there was an automation error. The incorrect price led to automatic liquidations of leveraged positions. He argued that Binance should have based USDe’s price on the broader market rather than an internal price source.

The sharp drop in USDe caused fear among investors: what if the stablecoin permanently lost its peg to the dollar? Social media messages amplified this uncertainty. Traders who had hedged their positions with USDe saw their margin disappear, causing their positions to be liquidated. This triggered a chain reaction of selling pressure, which Lee says was the catalyst for the crash on October 10 and 11.

Accusations of Manipulation #

Alongside technical explanations, voices on social media also spoke of deliberate manipulation. Investor Mike Alfred stated on X that “they” (the manipulators) are pulling out all the stops to push the bitcoin price down, with the goal of driving investors out of the market. He called it one of the biggest market scams ever. Tom Lee responded in agreement to his post.

Other well-known accounts, such as Ash Crypto, spoke of inexplicable price drops that they claimed were the work of cartels manipulating the crypto market. TRACER even pointed to large funds like BlackRock and Grayscale, alleging they were selling bitcoin to suppress the price.

It remains important to emphasize that these are largely speculative assumptions. Such theories often surface during periods of sharp volatility, but they should be interpreted with the necessary caution.