Photo: FotoField, Joey Sussman & LanKS (Shutterstock)

The financial world was eagerly awaiting new signals from the U.S. central bank, the Federal Reserve. However, last night remained conspicuously quiet regarding concrete policy directions.

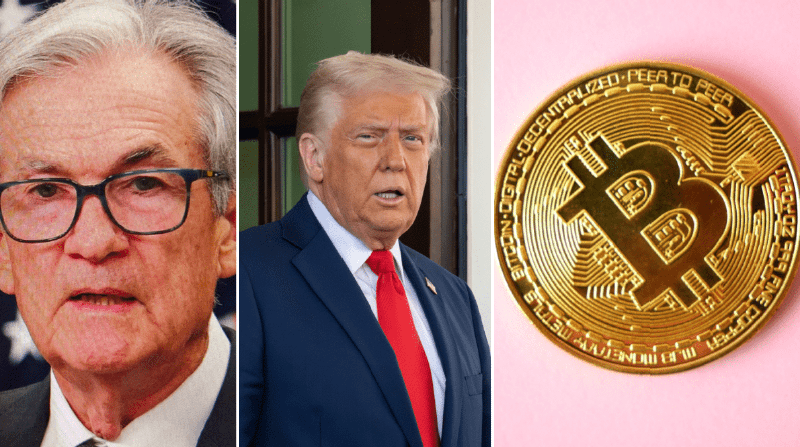

During a speech at the Hoover Institution, Fed Chair Jerome Powell chose to speak only about economic history, though his words resonated louder than some market watchers had expected.

Inflation History as a Hidden Message to the Market #

Powell began his speech with the words: “I will not be discussing current economic conditions or monetary policy.”

With that, he dashed expectations for potential interest rate cuts or liquidity measures.

This disappointment was particularly sharp because the next Fed meeting is less than two weeks away. Investors are waiting anxiously to see if the U.S. central bank will ease the brakes on the economy.

Notably, Powell focused on lessons from the past. He reflected on the wage-and-price controls from the era of President Richard Nixon, where government intervention was intended to curb inflation.

He noted that economic insights are constantly evolving and that we sometimes make assumptions today that will seem absurd in the future. This relativization of economic dogmas was immediately linked by analysts to current policy criticism.

For the cryptocurrency market, such uncertainty typically means increased volatility. Once the Federal Reserve pauses its balance sheet reduction, as it has now, more room opens up for risky investments.

This has previously led to price increases for assets like bitcoin, which often benefits from looser credit conditions.

Political Timing Increases Tension Around the Federal Reserve #

The timing of the speech also raised eyebrows. Donald Trump could nominate a candidate for Fed chair within the next few weeks.

The name Kevin Hassett comes up remarkably often in this context. With Powell’s term ending in May 2026, a political storm is brewing over his position.

This makes his explicit statement even more interesting: “We now understand that the central bank is responsible for price stability… that is a settled issue.”

Powell seems to want to emphasize both the anchoring of the Fed’s mandate and a warning against political interference. At the same time, the debate around central bank independence in Washington is more current than ever.

Consequences for Crypto Investors #

Powell’s plea for economic humility seems to be a message to both critics and successors: policy is never finished, but the goal (price stability) is fixed.

The question remains what the coming months will bring. A new Fed chair could chart a different course, with major consequences for the markets.