The profitability of Bitcoin holders can be divided into short-term and long-term holders. According to research, the profitability of the latter group has fallen to a low point, leading to a complete market shift.

Profits in Bitcoin Trading #

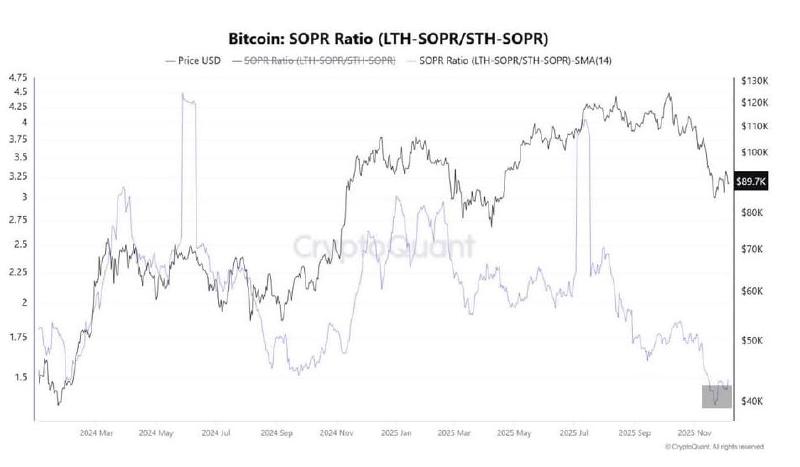

According to a blog post by analytics platform CryptoQuant, the Spent Output Profit Ratio (SOPR) has dropped to 1.35. This metric represents the ratio of spent Bitcoin in profit versus loss. When the ratio is high (2-4), it indicates that long-term Bitcoin holders (those holding for over 155 days) are aggressively cashing out their profits compared to short-term holders.

When the ratio is low, it means the gap between long-term and short-term Bitcoin holders is small. Currently, short-term holders are more frequently in profit than long-term holders, according to CryptoQuant.

The last time this metric was this low was in early 2024. Following the decline in Bitcoin’s price since October, this ratio has collapsed.

Where Do Bitcoin Holders Stand Now? #

The drop in Bitcoin’s price has triggered several developments. Many long-term holders sold their Bitcoin while the price was still high. Additionally, many positions betting on a higher Bitcoin price (longs) have been liquidated. Long-term holders who intended to sell have likely already done so and are no longer selling.

Short-term holders are now more often in profit than the other group. With long-term holders ceasing to sell, selling pressure has significantly decreased. A large group of speculators has been forced out of the market through liquidations.

A Renewed Bull Market? #

Although the market has cooled down, this also presents new opportunities. With the group of sellers exhausted, a bottom may have been found. According to CryptoQuant, once the number of buyers increases again, this could lead to a healthy rally and potentially a continuation of the stalled bull market.

However, the market still shows signs of volatility. On November 24, the group of short-term Bitcoin holders showed a significant peak, only to experience a sharp decline in early December when Bitcoin faced another major dip. Uncertainty prevails in the crypto market.