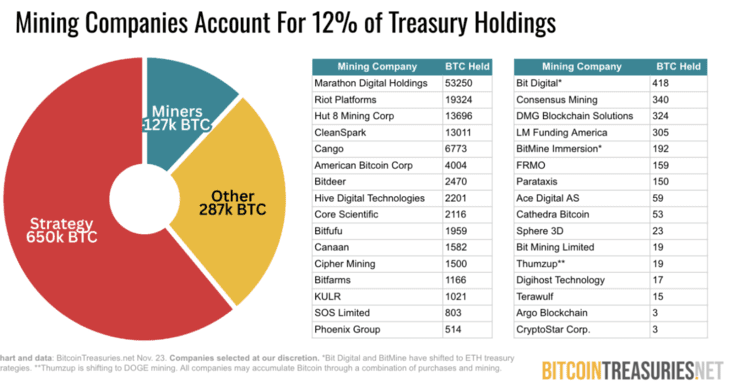

New market data indicates that Bitcoin miners are withdrawing more bitcoin than in previous months. At the same time, large corporations are adding less bitcoin to their reserves. This shift provides insight into how different groups are reacting to current market conditions. The development is significant, as miner activity and corporate bitcoin purchases often influence the available supply.

Why Miners Are Withdrawing More Bitcoin #

Miners receive bitcoin as a reward for their computational power. They typically sell a portion to cover operational costs. The recent increase in their holdings suggests they have more confidence in the current price level. Miners often react early to market changes because they deal directly with revenue and volatility on a daily basis. Their behavior is therefore seen as an important indicator of market sentiment.

This higher activity occurs during a period when miners are preparing for new investments in equipment and infrastructure. They use moments of lower market pressure to expand their positions. This offers insight into how production companies manage their reserves during uncertain times.

Companies Slow Down Bitcoin Adoption #

Companies that use bitcoin as part of their financial strategy are adding new reserves more slowly. This caution follows months of rising costs and prudent policies in boardrooms. Interest remains, but the pace of purchasing is lower than before. This slows the total inflow of institutional capital.

For many companies, liquidity now plays a larger role than in previous years. They are waiting for more clarity on future regulation and economic outlook. This has resulted in a temporary decline in demand from the corporate market.

What This Means for the Market #

The combination of higher miner activity and lower corporate inflow presents a mixed picture of the market. Miners are increasing their positions, while companies are showing more caution. This provides valuable information for traders who monitor changes in buying pressure and the available supply of bitcoin. The balance between these groups often determines short-term price direction.

In the coming period, the market will focus on new data regarding regulation and liquidity. Decisions from large companies and further activity from miners will receive particular attention. These factors will offer insight into how the dynamics between supply and demand will continue to evolve.