Bitcoin Expert: Price Could Crash to $70,000 Due to ‘Snowball Effect’ #

Photo: kravik93 & seahorsetwo (Shutterstock)

At the time of writing, Bitcoin is valued at $87,570, and the price is in a strong downtrend. A well-known analyst explains why the price is under significant pressure and why this may not be over yet.

Exceptionally High Liquidations with Bitcoin #

The price of Bitcoin has fallen by 24% in the past month. This is felt across the market, as many traders have fallen victim to this drastic price drop. Earlier this month, a staggering €1.2 billion in positions evaporated in just half a day.

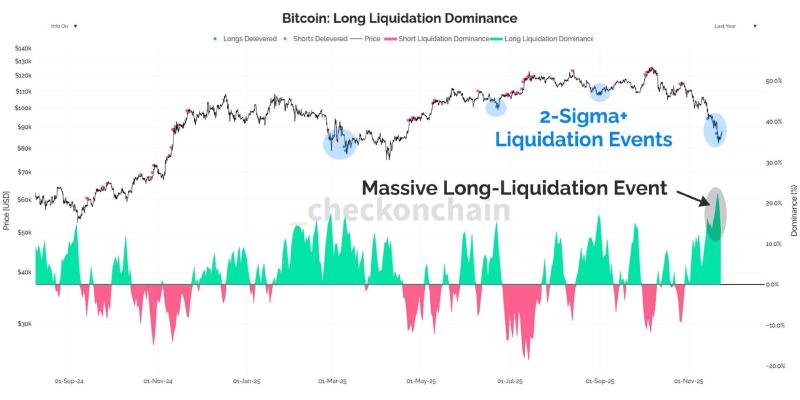

Analyst James Check shares on X that traders have lost an exceptionally large amount of money this month on the derivatives market. Here, traders buy and sell contracts (derivatives) to speculate on price rises or falls, rather than trading bitcoin directly.

However, when the price moves opposite to what traders bet on with their derivatives, the position is liquidated and the money vanishes. Due to the sudden price drops this month, a significant amount of liquidations have occurred.

“We just witnessed a 2-sigma long liquidation event, wiping out a large number of reckless gamblers,” Check said.

By 2-sigma liquidation, the analyst means that an unusually large number of positions were liquidated because the price dropped extremely. Sigma refers to standard deviation, a measure of the magnitude of fluctuations that normally occur.

Liquidations Cause Snowball Effect #

Check emphasizes the effect of liquidations on the market. Many traders whose positions were wiped out were using leverage, which amplifies losses.

With leverage, a trader essentially borrows money to artificially increase their position. The potential profit is much larger, but so is the loss.

Many of these leverage traders have been wiped out this month, as Check noted. This has increased selling pressure, creating a snowball effect on Bitcoin’s falling price.

Bitcoin Could Drop to $70,000 #

Check warns that the price drop may not be over yet.

Although much leverage has already been removed from the market due to the large number of liquidations, Check states that many positions remain open.

“We wouldn’t be too surprised if we hit the $70,000 to $80,000 zone and clear the last [leverage] out of the market,” the analyst speculates.