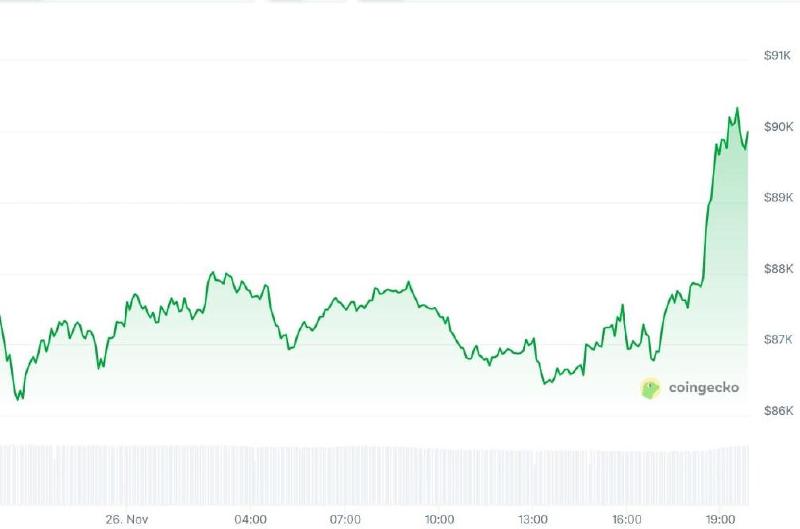

After a period of negativity, the Bitcoin price is finally back in the green. The cryptocurrency has climbed 2.5% over the past 24 hours, even posting a slight gain compared to a week ago. Is the bottom near? While many crypto investors are currently at a loss, this could actually be a positive signal. In a detailed analysis, analyst CryptoRank.io explains why.

Foto: JarTee.Shutterstock

Short-Term Holders at a Loss #

Bitcoin is currently trading above $90,000, having climbed from its recent dip to $80,500. One possible reason for the rebound is the renewed activity from BTC whales after a period of quiet, according to data from Santiment. Analyst CryptoRank.io suggests the price is approaching an accumulation zone where more investors may start buying in, which could further fuel Bitcoin’s price increase.

The crypto expert bases this analysis on the profitability of long-term and short-term holders. Through blockchain analysis, it’s possible to estimate the average purchase price of cryptocurrencies. According to CryptoRank.io, the analysis shows that long-term holders are still profitable on average, while short-term holders are now at a loss.

Bitcoin Accumulation Zone #

When the price falls below an investor’s entry point, it creates additional selling pressure from those at a loss, who are also less likely to buy more. The thinking is that long-term investors, who are still profitable, are less susceptible to panic selling. CryptoRank.io therefore sees this as a positive signal for a potential accumulation zone:

“Historically, when Bitcoin traded below the average purchase price of 1–2 year holders, it has signaled a strong accumulation zone.”

Accumulation is a phase where investors gradually build up positions because they find the price attractive. It often occurs after a price drop. Many analysts view it as a moment when less convinced investors (‘weak hands’) exit the market, selling their assets to more committed investors (‘strong hands’).

Accumulation Around $66,000 #

Currently, the accumulation zone is around the $66,000 level, says CryptoRank.io, but this level is dynamic:

“The longer Bitcoin remains above this level, the more the accumulation zone will gradually move upward.”

This is why some see the current Bitcoin price as a golden buying opportunity. “Historically, dips below these averages were buying opportunities, not panic triggers,” responds analyst Jack.

Is This Time Different for the Crypto Market? #

However, past results are no guarantee for the future. As the famous saying goes, history often rhymes, but it rarely repeats itself. Moreover, a growing number of analysts argue that the crypto market has changed and now behaves differently than in the past, especially since the advent of ETFs and institutional players. The question, therefore, is to what extent historical data can still serve as a reliable guide.