Foto: Ground Picture/Shutterstock

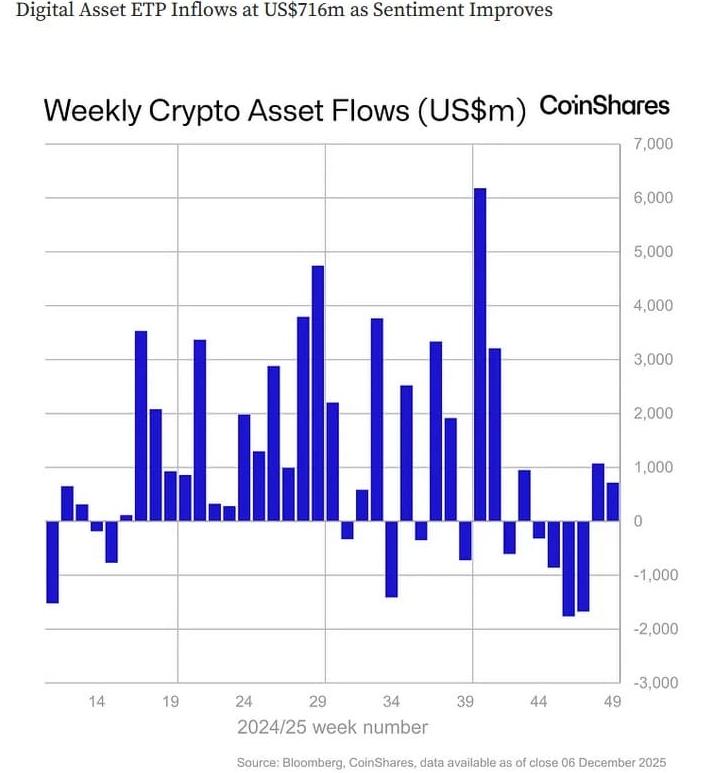

After four weeks of significant outflows, crypto funds are now seeing inflows for the second week in a row. Last week was a particularly strong week for these funds, with a total inflow of over a billion dollars. This week’s figure was lower, but still delivered a strong positive flow.

The Turnaround for Crypto Funds #

Six weeks ago, a veritable exodus began from crypto funds, such as the ETFs from BlackRock and Grayscale. More than $5.5 billion disappeared from these funds in four weeks. For the past two weeks, this has reversed into a positive flow of nearly $2 billion, according to research by James Butterfill of CoinShares.

The momentum from last week was sustained, with the various funds attracting $716 million in inflows:

There was some mild outflow on Thursday and Friday of this week, as macroeconomic data from the US pointed to persistent inflationary pressure, according to Butterfill.

Which Funds Performed Well? #

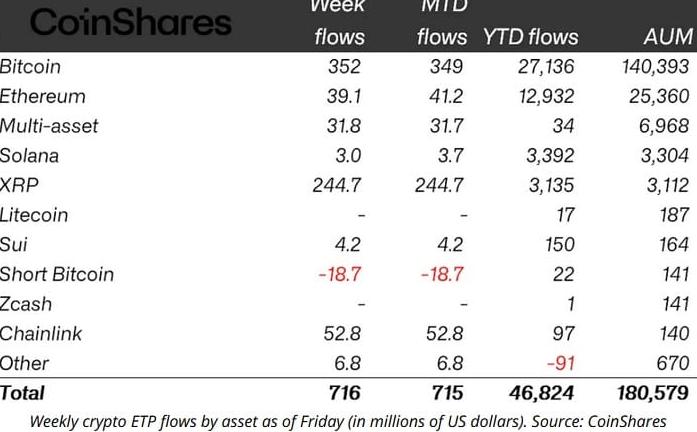

Bitcoin showed the most inflow in terms of volume, though it was not an exceptionally high figure. Many other funds also did not show exceptional numbers, except for the relatively new ETFs. Short Bitcoin lost $18.7 million, a sign that investors are less negative about the short-term price of bitcoin.

Chainlink saw a record inflow of $52.8 million. This fund is filling up fairly quickly and now has $140 million in assets under management (AUM) from its ETF.

XRP also performed quite well with an inflow of $244.7 million. This indicates that the new funds for high-ranking coins are still gaining significant traction.

In total, there is now $180.579 billion in assets under management (AUM), still well below the all-time high of $264 billion where it once stood.

Winners and Losers #

ProShares was the biggest winner, showing $210 million in inflows. Fidelity also did quite well, seeing $62 million flow in.

BlackRock did not have its best week and saw $105 million flow out. Ark 21 Shares also performed poorly, losing $78 million from its funds.

In the United States, $483 million flowed into the various crypto funds. In Germany, the figure was $97 million, and in Canada, $80.7 million. Sweden seems to be missing out, seeing an outflow of $5.6 million, bringing the total outflow from Swedish funds this year to $836 million.