Introduction #

The crypto market faced another harsh reality check. After what seemed like a calm recovery, sentiment shifted rapidly, and a wave of bullish positions was wiped out. Within a single day, $584 million (nearly €500 million) in open crypto positions evaporated. Most liquidations were long positions—bets on price increases. The biggest hits were in Bitcoin and Ethereum, where optimistic traders took the brunt of the losses.

Bitcoin Plummets #

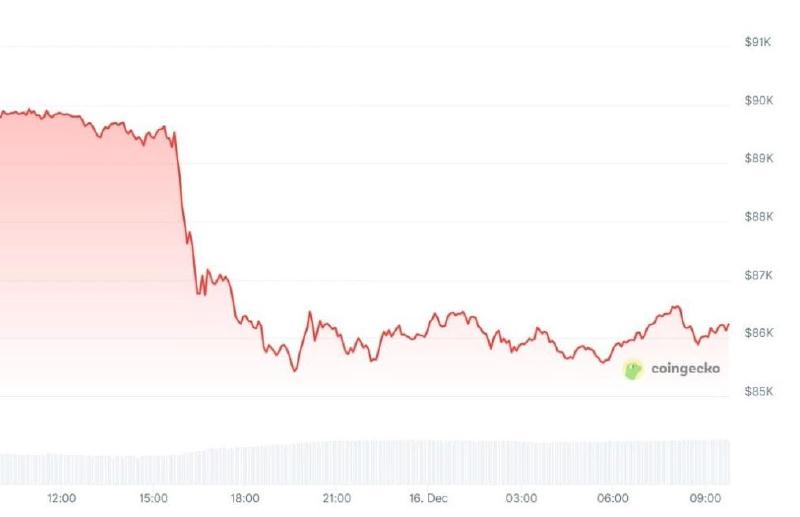

Bitcoin initially seemed to be on the right track, with the BTC price crawling toward $90,000. However, this level proved too heavy to break. Precisely when U.S. stock markets opened, things went south. This timing has often triggered sharp shocks in crypto recently, and today was no exception. In less than an hour, Bitcoin dropped over 3%. It first touched $86,700 and later fell to $85,300 in the evening. The price now hovers just above $86,000. Ether also plunged sharply, playing a major role alongside Bitcoin in the market bloodbath.

Liquidation Cascade #

The decline was amplified by a wave of liquidations. This occurs when traders use leverage (borrowed funds). If losses become too large, platforms automatically close their positions. A sudden price drop can trigger a chain reaction: one liquidation fuels the next, forcing more positions to be sold.

Hundreds of Thousands of Traders Hit #

In total, nearly 182,000 traders were liquidated. The largest losses were in Bitcoin and Ether, together accounting for over €350 million in liquidations. Long positions were hit hardest: over 87% of all losses came from them. In total, 190,000 traders went under. The hardest-hit exchanges were Binance, Bybit, and Hyperliquid. On Hyperliquid, 98% of liquidations were longs—a clear sign of extremely one-sided positioning. On Binance, a single BTCUSDT position worth over €9 million was liquidated. Altcoins didn’t escape the misery: Solana saw over €30 million in liquidations, while XRP and Dogecoin recorded around €13.5 million and €10 million, respectively.

Market Context #

This downturn occurred in a market with thin liquidity and predominantly negative sentiment. Notably, no major negative news preceded it. Thus, this wasn’t a news shock but a correction in a market overly reliant on leverage.