The crypto market is undergoing a transformation, and not just in terms of price. Trading with leverage and complex financial products is becoming increasingly common, causing price swings to become faster and more intense. What might have been a standalone correction in the past can now trigger a cascade of liquidations. This article explores the scale of this leverage market, what went wrong during the sharp October sell-off, and why Bitcoin is increasingly becoming the center of the market.

The Rise of Leverage Trading #

According to a report by Glassnode and Fasanara, the average daily value of settled futures contracts has surged. In the previous cycle, daily settlements averaged $28 million in long positions and $15 million in short positions. This cycle, those numbers have jumped to $68 million for longs and $45 million for shorts.

This was most evident on October 10, 2025, an event researchers dubbed ‘Early Black Friday’—a massive sell-off of both Bitcoin and altcoins. During this crash, more than $640 million in long positions were liquidated per hour. Bitcoin itself plummeted from $121,000 to $102,000, and the open interest (the total value of outstanding contracts) shed 22% in just 12 hours, falling from $50 billion to $39 billion.

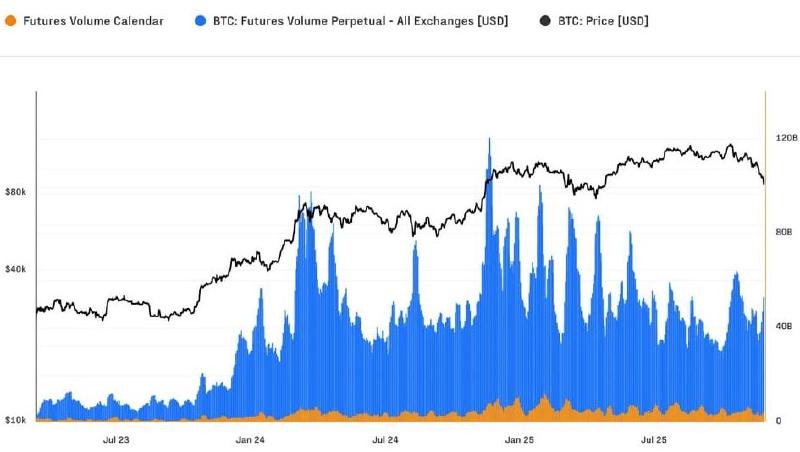

Activity on the futures market reached a trading volume of €69 billion in October 2025, with 90% of this consisting of perpetual futures:

As seen in the image above, Bitcoin futures trading has exploded since late 2023. The highest volumes coincide with strong upward price movements for Bitcoin.

Capital Flows into Bitcoin #

Spot trading volume (trading without leverage) has also doubled since the last cycle. According to the Glassnode report, it has climbed to between $8 billion and $22 billion per day. During the October 10 crash, Bitcoin’s spot trading volume hit $7.3 billion per hour—more than three times recent peaks—as traders bought the dip instead of fleeing the market.

Glassnode notes that the arrival of spot Bitcoin ETFs in early 2024 shifted Bitcoin’s price discovery to the cash market, while leverage became more concentrated in futures. As a result, Bitcoin captured more market share, with its dominance rising from 38.7% to 58.3%.

Monthly inflows into Bitcoin ranged between $40 billion and $190 billion. This has resulted in a capital injection of $1.1 trillion since the previous cycle’s low in 2022—more than all previous cycles combined. According to Glassnode, this points to a more mature and institutionally anchored market.