The maturation of the crypto market presents significant opportunities, but it also brings increased regulatory scrutiny. Governments are not only seeing growing trading volumes but also new risks associated with digital assets.

This has led to a global wave of new legislation, with tax laws and financial regulations being adapted at a rapid pace. This development simultaneously highlights that cryptocurrency is securing a more serious position within the traditional financial world.

Countries Prepare New Tax Rules #

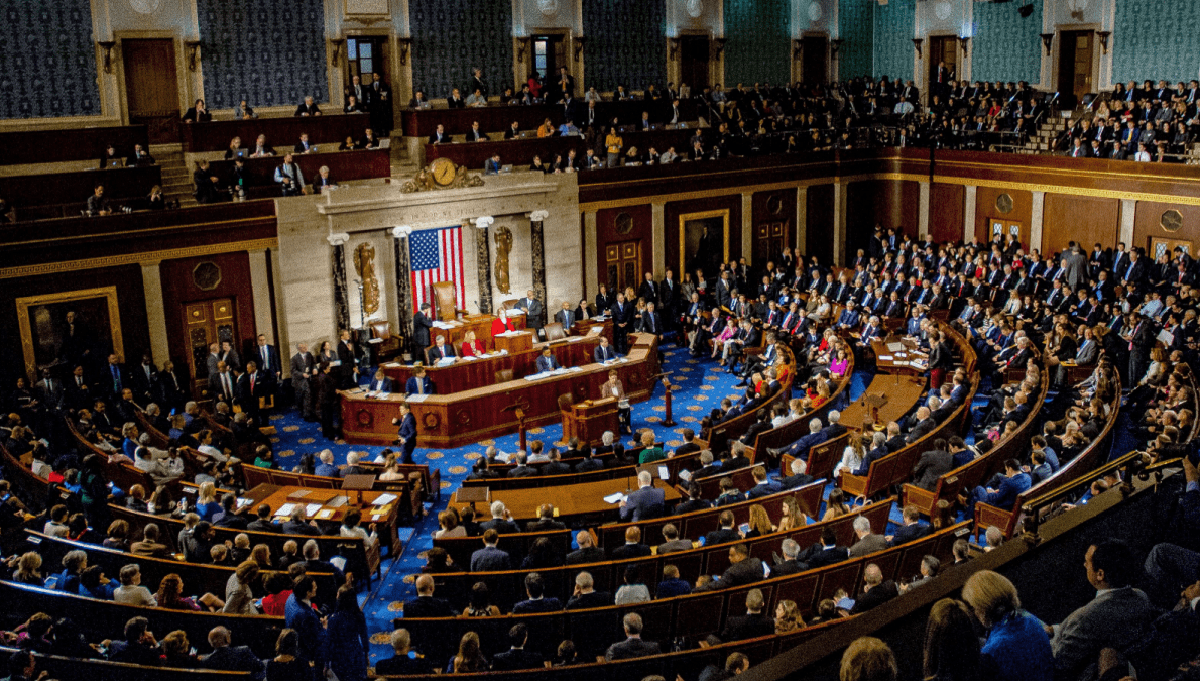

In the United States, the White House has proposed new plans to align with the international Crypto Asset Reporting Framework (CARF). This system is designed to help countries better monitor transactions, especially as crypto in the U.S. is treated as property and falls under capital gains rules.

Concurrently, work is underway on the Bitcoin for America Act, which would allow Americans to pay their taxes in bitcoin. The BTC would then be held by the government in the Strategic Bitcoin Reserve that was established earlier this year.

Other nations are also overhauling their tax systems. Brazil plans to tax international crypto transactions starting in 2026 as if they were foreign currency exchanges. This means that stablecoins will also fall under stricter regulations.

Meanwhile, South Korea is working on a flat 20% tax on crypto profits, although its implementation has been delayed multiple times. These measures indicate that governments worldwide are increasingly treating crypto as conventional financial assets.

Financial Sector Gains More Room for Crypto #

The growing regulatory push is not limited to taxes.

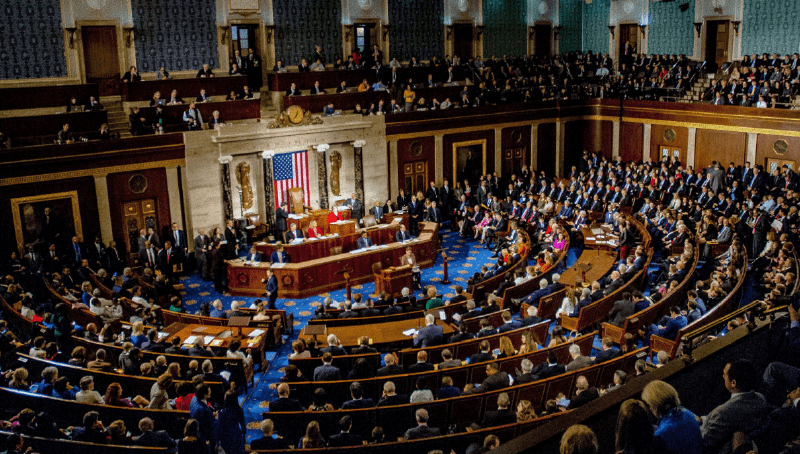

In the United States, banks are now officially permitted to hold certain cryptocurrencies on their balance sheets to execute transactions on blockchains. Previously, they had to use complicated workarounds, such as external wallets or trading platforms.

Thanks to new guidelines from the Office of the Comptroller of the Currency (OCC), banks can, for example, hold Ethereum to pay for gas fees—the transaction costs required to perform operations on a network like Ethereum.

This comes at a time when banks themselves are becoming more active in the sector. JPMorgan recently launched its own stablecoin on the Base network, fully pegged to the U.S. dollar and designed for fast business payments.

The global shift toward clear regulation demonstrates that crypto is no longer seen as an experiment. With new laws, stricter tax rules, and banks beginning to use crypto systems themselves, the sector is at the dawn of a new era.