The crypto market is beginning the month with significant losses. Bitcoin and other major cryptocurrencies are seeing steep declines, and large investors are feeling the impact. After showing signs of recovery last week, market sentiment has now soured. The price drops are not only due to internal crypto developments but also to changes in Japan that are influencing investments worldwide. What does this mean for bitcoin and other coins in the near future?

Market Overview: Deep Red Prices #

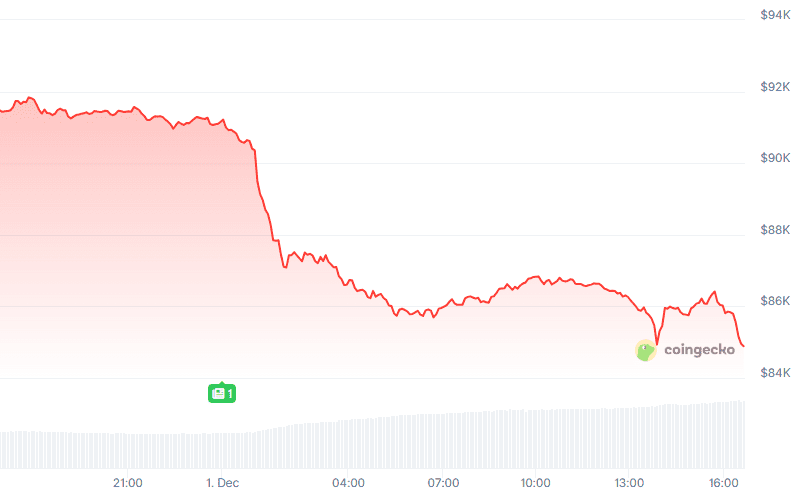

The price of bitcoin has fallen sharply today by 7.6% to $84,500. Where the price was still showing signs of recovery over the weekend, it has completely collapsed today.

The blow also hits large institutional parties hard. The stock of Michael Saylor’s Strategy, the world’s largest bitcoin holder, is down 7% today. According to The Kobeissi Letter, the stock has more than halved since the beginning of October.

BREAKING: MicroStrategy, $MSTR, falls over -7% on the day to its lowest level since October 2024.

The stock is now down -55% since October 6th in one of its steepest declines on record. pic.twitter.com/Tx79iTLOhC

— The Kobeissi Letter (@KobeissiLetter) December 1, 2025

The rest of the top 10 is also taking heavy hits today. Ethereum is down over 9% to $2,751. XRP also lost nearly 9% and is back at the $2 mark. BNB and solana are currently showing double-digit losses, with both coins down 10%.

Data from Japan Shocks the Market #

This is not simply due to problems with bitcoin itself. It is mainly related to changes in the world of money and loans, especially in Japan.

Analyst Shanaka Anslem Perera shares his analysis of the situation in a post on X: He notes that interest rates on Japanese government bonds have risen sharply. The 10-year bond rose to 1.877%, the highest since 2008, and the 2-year bond rose above 1% for the first time since the financial crisis. This made borrowing in Japan more expensive.

For a long time, people borrowed money cheaply in Japan to invest elsewhere, for example in stocks, bonds, and even bitcoin. According to Perera, this is called the yen carry trade. Experts estimate that between $3.4 and $20 trillion was used for this. Due to higher interest rates, this became less attractive, and investors began to sell en masse, including today.

All those sell-offs caused prices to fall quickly, says Perera. On October 10 alone, $19 billion worth of crypto positions were sold. In November, investors withdrew $3.45 billion from Bitcoin ETFs, with the BlackRock fund losing $2.34 billion. Today, December 1, another $646 million in sales was added.

The upcoming Bank of Japan decisions on interest rates can further influence prices. If rates rise, Bitcoin could remain lower. If rates remain stable, the price could rise quickly again, according to the analyst.

What Does This Mean for Crypto? #

According to an analysis by Bull Theory, there are several consequences for crypto – the analyst states the following:

In the short term, bitcoin and other cryptocurrencies are sensitive to changes in Japanese government bonds. Volatility increases, as is now the case, and a strong yen can put pressure on risky markets.

In the medium term, rising interest rates can bring policymakers closer to easing. News that tightening is delayed is usually positive for crypto, which often moves faster than stocks.

In the long term, every liquidity cycle begins with a shock. Crypto often stabilizes earlier than stocks during easing, and bitcoin usually leads the next wave of liquidity.

Today’s Top Gainers in the Top 100 #

On this depressing day for the crypto market, there is only one coin that managed to make a profit:

| Name | Gain (24h) | Price |

|---|---|---|

| Rain | 11.3% | $0.0079 |

Today’s Top Losers in the Top 100 #

Losers, on the other hand, were more than plentiful today. Among others, the well-known sui is in the top 3 of biggest losers.

| Name | Loss (24h) | Price |

|---|---|---|

| Zcash | 20% | $352 |

| Pump.fun | 15% | $0.0025 |

| Sui | 14.4% | $1.32 |

| Aster | 14.6% | $0.90 |

| NEAR Protocol | 13.3% | $1.60 |