After a period of declines, the crypto market is showing a cautious recovery today. Bitcoin and other major top 10 coins are posting gains, while key developments from the US and institutional players provide extra optimism for investors. Ethereum, in particular, seems to benefit from new applications and growth opportunities, contributing to a positive market sentiment.

Market Overview: Positive Developments for Crypto #

The crypto market is cautiously in the green today, up 1.5%. This brings the total market capitalization to $3.16 trillion (€2.71 trillion). Notably, Bitcoin is lagging behind other major top 10 coins.

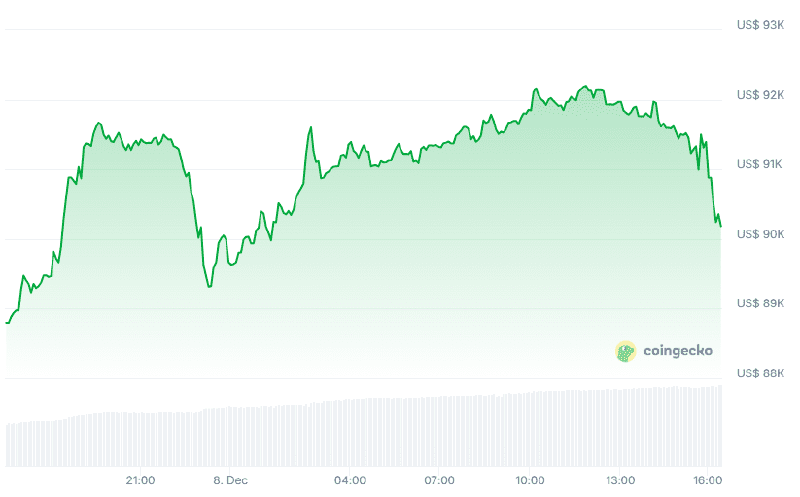

Bitcoin’s price has risen by 1% today, bringing ‘digital gold’ to $90,023 per Bitcoin. The chart shows that the price briefly dipped below the $90,000 mark last night but quickly recovered. During the day, the price has remained relatively stable but is showing a slight decline at the time of writing.

Bitcoin has had a weak quarter, falling by over 18% in three months. However, macroeconomic developments from the US paint a potentially positive picture for Bitcoin and the rest of the crypto market. According to various sources, the US Federal Reserve will start buying back bonds worth $45 billion per month starting in January.

These Fed purchases are positive for crypto because they pump a lot of extra money into the financial system and keep interest rates low. This makes traditional investments like savings accounts and bonds less attractive, leading investors to turn to riskier assets like Bitcoin.

Additionally, investors are looking forward to the Fed’s important interest rate decision this Wednesday.

Furthermore, Ethereum rose convincingly by 4.6% today, bringing its price to just below $3,100. This growth is accompanied by several positive developments for Ethereum.

First, it was revealed that crypto giant Coinbase will approve loans in the US using Ethereum as collateral. Dutch analyst Merlijn The Trader reacted to the news:

"Ethereum is no longer a ‘technical investment’. It’s becoming a collateral asset. And collateral assets win every cycle."

BULLISH: 🇺🇸 Coinbase now lets Americans take loans using Ethereum as collateral. Ethereum isn’t a "tech play" anymore. It’s becoming a collateral asset. And collateral assets win every cycle. pic.twitter.com/2eg7TiaqQQ — Merlijn The Trader (@MerlijnTrader) December 8, 2025

Additionally, the largest asset manager BlackRock announced that it has filed an application with the US financial watchdog (SEC) for an Ethereum exchange-traded fund (ETF) with staking capabilities.

Staking in crypto involves locking up your coins in a blockchain network to help secure the network and validate transactions. In return, you receive rewards, often in the form of additional coins. For investors, it is interesting because it offers a way to earn passive returns on their crypto.

Further in the top 10, XRP, BNB, Solana, and Dogecoin are also up by 3%, 2%, 5.4%, and 4.5% respectively.

Today’s Top Gainers from the Top 100 #

| Name | Gain (24h) | Price |

|---|---|---|

| Zcash | 18% | $399 |

| Canton | 17.6% | $0.073 |

| Pepe | 9.7% | $0.00000047 |

| Ethena | 8.7% | $0.27 |

| Bittensor | 6.3% | $291 |

Today’s Top Losers from the Top 100 #

| Name | Loss (24h) | Price |

|---|---|---|

| HTX DAO | 1.2% | $0.00000016 |

| Monero | 0.7% | $372 |

| Quant | 0.2% | $88.50 |

| Pi Network | 0.2% | $0.218 |