The price of Dogecoin (DOGE) climbed by about 2.7% over the past 24 hours, breaking through a key resistance level. The upward momentum is primarily driven by retail investors, as activity from large holders, or ‘whales,’ has notably decreased. Meanwhile, an analyst has highlighted a compelling pattern on Dogecoin’s chart.

Retail Investors Drive the Dogecoin Price #

With the recent surge, Dogecoin broke through the resistance level of $0.15 (approximately €0.13) following a strong increase in trading volume. On Tuesday, the volume tripled compared to the daily average, which mainly indicates buying pressure from retail investors.

The price has since stabilized somewhat. Compared to 24 hours ago, the price is down 0.6%.

At the same time, transactions from ‘whales’—large parties that can significantly influence the market—have fallen to their lowest point in months, according to data from analytics platform Santiment. This divergence suggests that the current rally does not yet have broad support from major investors.

Technical Analysis Shows Bullish Signals for Dogecoin #

The Dogecoin price is moving within an ascending channel, indicating sustained buying pressure. This pattern, characterized by progressively higher lows, has formed a new important support level around $0.1470.

Additionally, analyst Trader Tardigrade pointed out on X (formerly Twitter) a ‘Dragonfly Doji’ on the weekly chart. This candlestick pattern can signal a trend reversal after a decline. “This bullish pattern indicates that buyers have rejected lower prices,” the analyst stated. He suggests this “could mark the beginning of the journey towards $1.”

$Doge/weekly

🚨 #Dogecoin weekly candle signals a bullish reversal pattern 🚨A Dragonfly Doji has appeared at the key support level. After a downtrend, this bullish reversal pattern indicates that buyers have rejected lower prices, pushing the price to the top of the candle.… pic.twitter.com/TOz619thKA

— Trader Tardigrade (@TATrader_Alan) December 3, 2025

Of course, no one knows what the Dogecoin price will do in the future, so always do your own research and don’t rely solely on individual analysts or experts.

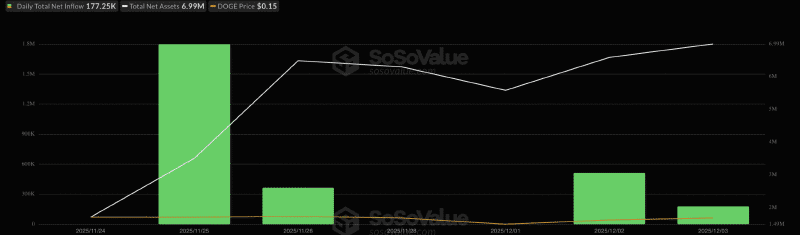

New ETFs Attract Initial Capital #

Meanwhile, there has been a cautious inflow of capital via recently launched American spot Dogecoin exchange-traded funds (ETFs), such as Grayscale’s GDOG and Bitwise’s BWOW. According to data from SoSoValue, these funds have realized a cumulative inflow of €2.4 million since their launch.

Looking at the charts, there are several key price levels to watch. For a continuation of the rally, it is crucial that the price remains trading above the support level of $0.147. A successful consolidation above this point opens the door to the next price targets around $0.1530 and the resistance zone between $0.158 and $0.16 (approximately €0.14).

However, if the support fails to hold, the likelihood of a correction increases. A drop below $0.147 could lead to a fall back to $0.1430. The reliance on retail investors makes the current price rally vulnerable without support from larger players.

Last month, Elon Musk, a major Dogecoin supporter, made a notable statement. “It’s time,” the billionaire said regarding fulfilling an old promise he made to Dogecoin long ago.