The Netherlands has long been known as a nation of savers. From a young age, we learn that a financial buffer is essential and that every euro counts. Recent research once again highlights how deeply this savings mentality is embedded in our culture: collectively, the Dutch have now set aside more than €500 billion, averaging around €30,000 per person. Yet, there are significant differences among savers, and the pressure to manage money wisely is growing.

ING Savings Survey 2025 #

ING Bank has conducted its annual survey on savings. The study reveals that saving is instilled from an early age. On average, the Dutch are building increasingly larger buffers. Three out of five savers have around €3,000 set aside for a rainy day.

The research also shows that the number of people with a buffer of more than €10,000 has increased by 10% in just two years. Monthly contributions are also on the rise, with half of the people setting aside an extra €200 each month.

However, 20% of the Dutch population has less than €500 in their accounts. They are concerned about their buffer. Meanwhile, about a third now invests in various types of assets.

Why Do People Save So Much? #

Many Dutch people find saving not only useful but also necessary. They were taught by their parents that saving is wise. 75% of this group also wants to pass this lesson on to their children by talking about money and encouraging part-time jobs.

A small group is particularly good at saving because they want to do better than their parents, who, according to the survey, saved nothing.

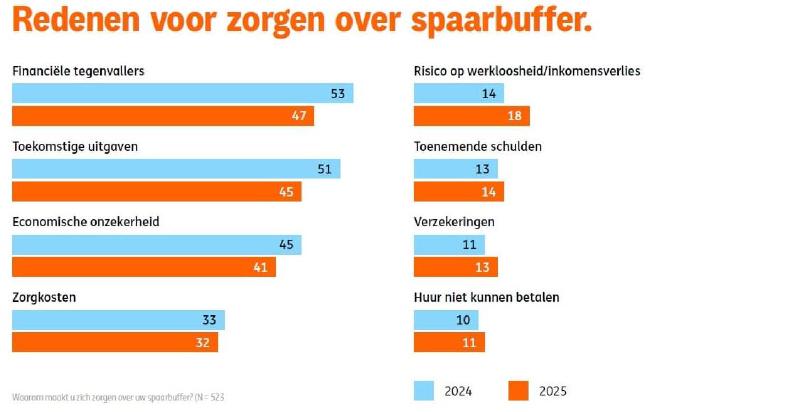

More than half of respondents express concern about their savings buffer, citing financial setbacks, economic uncertainty, and future expenses as the main reasons.

Trends and the Difficulty of Saving #

In today’s world, it is harder to save than it was for previous generations. Young people indicate that saving is difficult due to the many temptations they face and the ease with which money can be spent. It is primarily the younger generation that has less than €500 in their accounts.

A third of the Dutch population now invests, compared to a fifth in 2023. 47% save more than €200 per month, and a fifth save more than €500. 13% still keep their money in a physical piggy bank out of principle.

ING has also developed a method for measuring financial health. It highlights that automatic saving and saving with a specific goal are the most effective strategies. You can now also place a savings lock on your money. Four out of ten people still deposit their savings manually, which ING suggests could be improved.