Ethereum is making headlines again in the crypto market. After a period of declines, the second-largest cryptocurrency has climbed back above the $3,300 mark. This reclaim comes amid growing investor confidence and significant developments, with a well-known analyst eyeing further upside for the digital asset.

Ethereum Price Reclaims $3,300 #

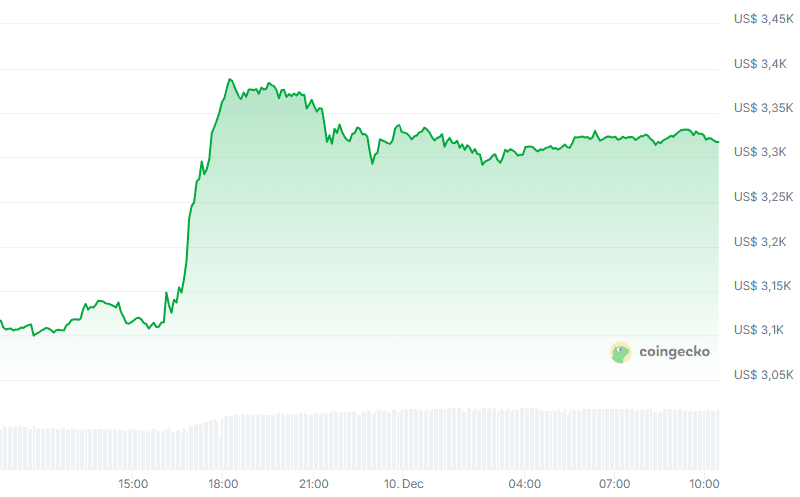

The price of Ethereum has surged by 6.4% in the last 24 hours, allowing the second-largest cryptocurrency to reclaim the $3,300 level. The last time ETH traded at this level was about a month ago, on November 13.

After a few tough weeks that saw the price dip to $2,700 twice, the asset now appears to be slowly regaining momentum. At the time of writing, Ethereum is the only top-10 cryptocurrency showing green figures over the past week, with a total gain of 8.3%.

Analyst: Ethereum Price Could Head to $3,700 #

According to analyst Ted Pillows, Ethereum’s price appears to be gearing up for a move towards $3,700. In an analysis on X, the analyst shared the following conclusions:

“Ethereum is trying to break above a crucial resistance level. A reclaim of the $3,300-$3,400 level will push Ethereum towards the $3,700 level. A rejection from this level will push ETH below the $3,100 zone.”

At the time of writing, the price is at $3,320. According to the analyst, this means ETH has reclaimed the crucial $3,300 level, and his forecast suggests the price should now push towards $3,700.

Major Capital Inflow #

Today’s price surge coincides with recent developments involving Ethereum and asset manager BlackRock. The American investment giant announced on Monday that it has filed an application for a new Ethereum exchange-traded fund (ETF) with U.S. regulators.

What makes this new fund unique is the option for investors to earn a form of interest on their investment, known as staking. This feature is often attractive to investors as it allows them to generate passive income on their holdings.

Additionally, according to Ted Pillows, BlackRock invested another $35 million in Ethereum yesterday. This made the asset manager a key contributor to the massive capital inflow into Ethereum ETFs yesterday. A total of $177 million flowed into Ethereum ETFs, marking the largest inflow in weeks.

$ETH ETF inflow of $177,700,000 🟢 yesterday.

BlackRock bought $35,300,000 in Ethereum.