For the past few days, Ethereum’s price has been hovering around $3,000. According to one analyst, ETH could soon push toward $3,200. Notably, the reason isn’t hype or news, but something more unique: unusually low yields on crypto lending platforms.

Ethereum Eyes $3,200 as Low Stablecoin Yields Signal Room to Grow #

Like the rest of the crypto market, Ethereum has seen sharp declines over recent months. Now, conditions appear to be improving for the coin, shares analyst Maksim from the Santiment analytics platform.

Ethereum has potential to rise to $3,200, according to Maksim. The analyst bases this on the yields offered by stablecoins—cryptocurrencies with stable values pegged to assets like the euro or U.S. dollar. Stablecoins can generate returns for traders, such as on lending platforms. Currently, these yields are low, around 4%. This suggests weak demand for loans. A market top is often accompanied by high yields on lending platforms.

“This shows the market hasn’t reached a major top yet and can still climb higher,” the analyst said.

A Crucial Juncture for Ethereum #

$3,200 doesn’t have to be the peak, according to Maksim. The coming days will reveal whether Ethereum’s price can break through the resistance between $3,200 and $3,250.

This is a critical point for the cryptocurrency, the analyst notes. Buyers and sellers are currently balanced, leaving the market without a clear direction.

Whether the price breaks above the resistance or falls back, new indicators will need to be examined in both cases to determine Ethereum’s next move.

Current Price Action #

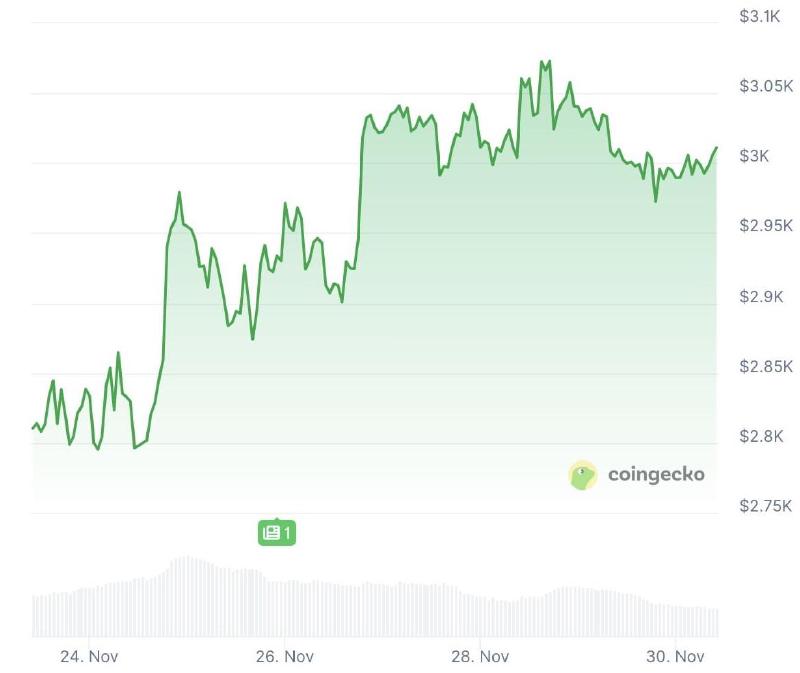

As the Santiment analyst indicates, Ethereum’s price is currently fluctuating. Over the past seven days, Ethereum has risen 7%, but compared to a month ago, it’s down nearly 22%.

At the time of writing, the coin is valued at $3,010 and has been hovering around this price for over four days. Just over a week ago, the price found support around $2,800, a familiar support level for Ethereum.

ETH/USD 7-day price chart. Source: Coingecko