The crypto market is seeing red this week, and Ethereum is no exception. The price has fallen below a crucial level, risking further declines. However, one key indicator has just flashed green for the asset.

Ethereum Drops Below $3,000 #

The price of Ethereum, like the rest of the crypto market, started the week in the red. Yesterday, the asset’s value fell by approximately 6.5% in a single day, and today there is little sign of a recovery.

With the recent price drop, Ethereum has fallen below the $3,000 mark, a significant price level for the cryptocurrency. At the time of writing, Ethereum is valued at $2,804, which is 3% lower than it was a week ago.

These Price Levels Are Crucial for Ethereum #

The importance of the $3,000 level for Ethereum is evident for several reasons. It’s not only a psychological barrier but also a technical level that can provide substantial support and resistance.

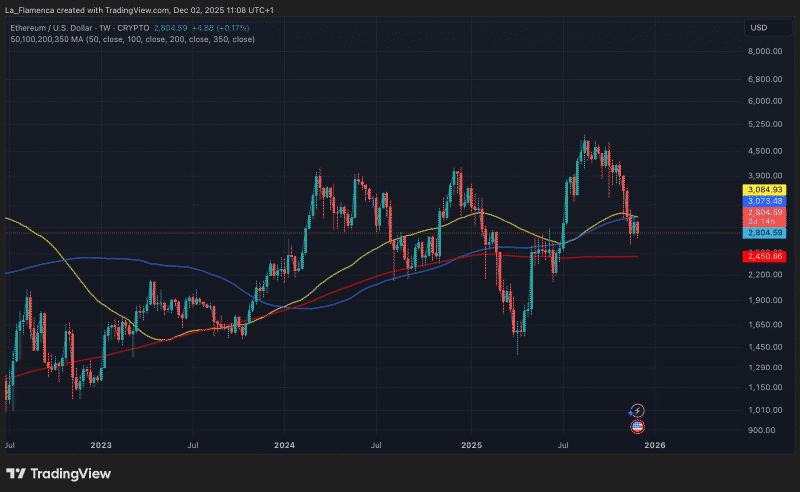

Around the $3,000 price point, two moving averages (MAs)—the 50-day and 100-day—converge. These are represented by the yellow and blue lines in the chart below.

The price level where the 50-day MA and 100-day MA cross is significant because it often indicates a potential shift in market trend. The 50-day MA reacts more quickly to recent price movements, while the 100-day MA is slower, so their crossover shows whether short-term momentum is becoming stronger or weaker than the medium-term trend.

Analyst Daan shares on X that $2,850 is another important level to watch. This is a historical support level, and if Ethereum drops below it, a fall towards $2,100 is possible, according to the analyst. Currently, Ethereum is hovering just below this level and is therefore at risk based on the above analysis.

$ETH Good hold of the key support area for now.

Looks like this weekly close is going to be a decent one.

From here on out you got a very clear invlidation below these local lows. That is a key area to defend for the bulls.

$2850 & $3350 are the levels that matter in this… https://t.co/p25W965813 pic.twitter.com/FVAH1wyTaC

— Daan Crypto Trades (@DaanCrypto) November 29, 2025

A Positive Signal for Ethereum #

Although Ethereum is in a danger zone, there are not only bearish signals in the market. One important indicator even suggests that Ethereum may have found a bottom.

This is the MVRV Z-Score, an indicator that compares market value to realized value—the difference between the purchase and sale price of Ethereum. The MVRV Z-Score shows whether Ethereum is undervalued or overvalued at its current market price.

According to data from Capriole, the MVRV Z-Score is at a low point. The last time it was this low was in June of this year. At that time, Ethereum rose by more than 100% in a few months.