Photo: Trismegist san/Shutterstock

Companies holding Ethereum as a strategic reserve (known as DATs) are in trouble. They purchased Ethereum at a higher price than its current value. From a price of nearly $5,000 in August 2025, only about half remains. As a result, many of these companies are sitting on millions of dollars in unrealized losses (which would become realized if they were to sell now).

Ethereum’s Price Action #

Ethereum has lost approximately 30% of its value this month. It is now trading below $3,000, a level not seen since July when it began its ascent. Institutional demand is declining, and technical indicators are leaning bearish, meaning a further correction cannot be ruled out.

The price of Ethereum has now been falling for four weeks. A bearish fractal points to a deeper correction on the horizon. A market fractal is a recurring pattern that traders use in technical analysis to identify trend reversals. This fractal looks like this:

Ethereum price chart with the blue curved line indicating the fractal. Source: kanguhulabale / TradingView.

A similar fractal formed in 2022 after the bear market began. At that time, the bottom was found at the 200-week simple moving average (SMA).

The same scenario is playing out now. The price has fallen by more than 40% from its all-time high in August 2025. If the 200-week SMA is used as a reference point, the last line of defense for the bulls (those who want to see higher prices) is $2,450.

Ethereum’s “Supertrend Indicator” has recently issued a sell signal on its weekly chart. The last time this signal appeared, it was followed by a 66% price drop in March 2025.

A similar signal in January 2022 was followed by an 82% price drop, with the bottom found just below the 200-week SMA. If history repeats, a correction could occur, pushing Ethereum even below $2,000.

Losses for Reserve Companies #

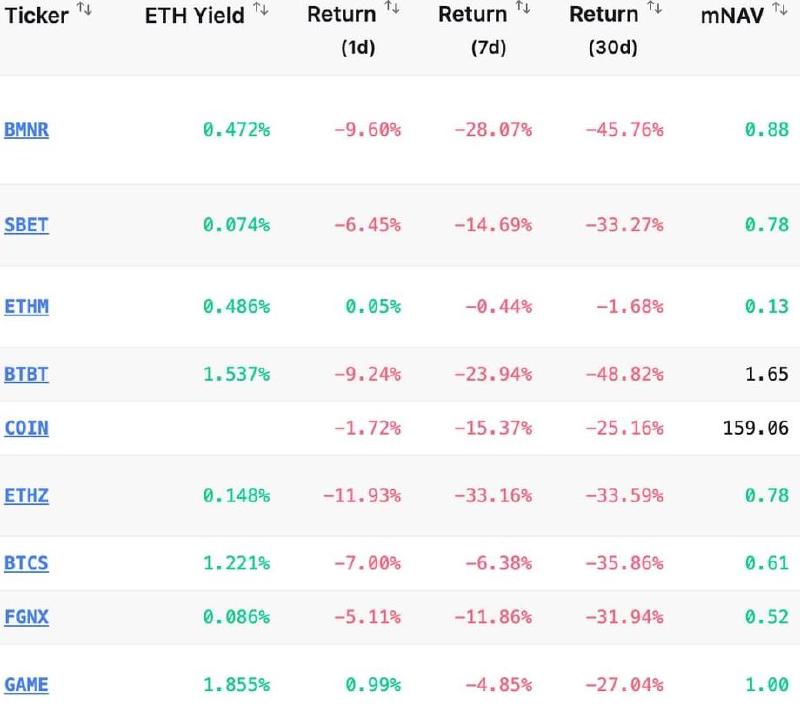

Data from Capriole Investments shows that many companies with Ethereum in their reserves are suffering significant losses:

Performance of Ethereum reserve companies over the past month. Source: Capriole Investments.

This is not surprising given the sharp correction in Ethereum’s price. However, some companies will now struggle to attract new capital precisely when they need it most. Their market value will decrease, which could cause their stock prices to fall sharply.

Since November 11, some companies have also sold off a portion of their Ethereum reserves. Additionally, Ethereum ETFs are experiencing outflows.