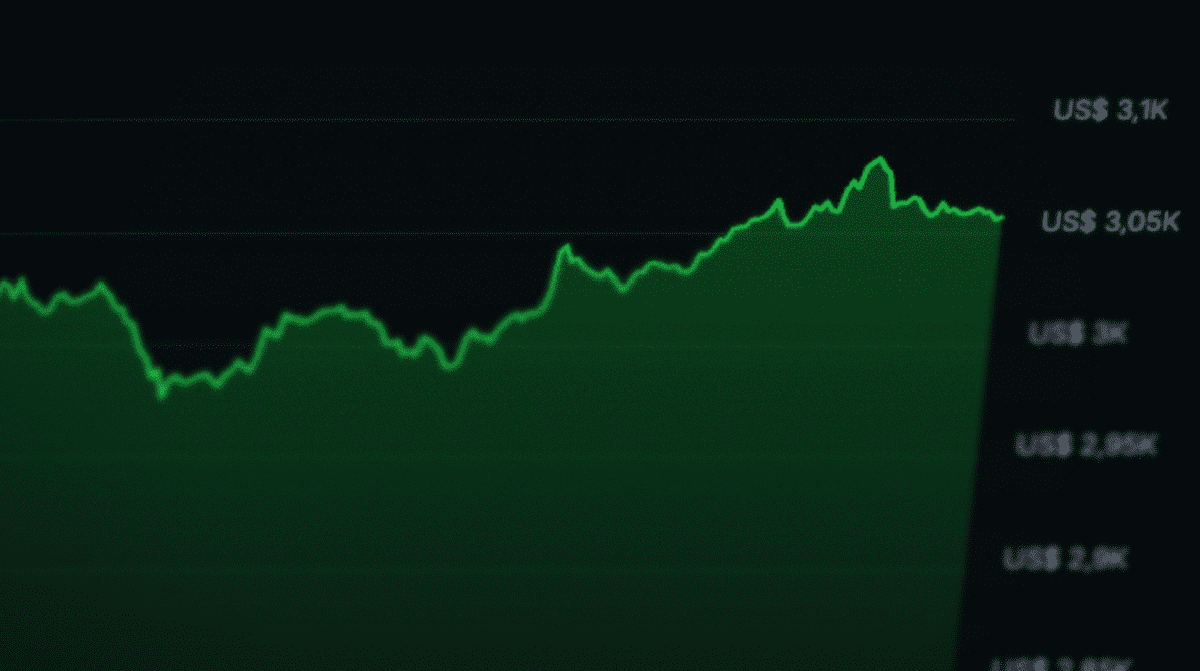

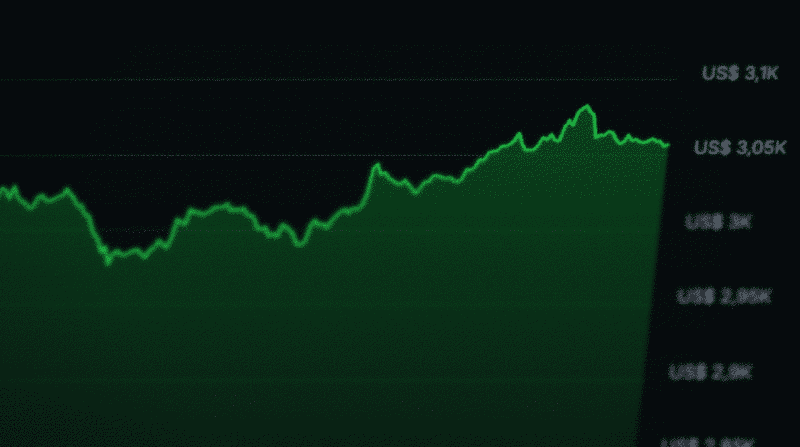

The crypto market is flashing green today, with many coins recovering from recent losses. Ethereum is a standout, surging 9.5% to trade around $3,050 at the time of writing. Notably, this rally coincides with a sharp increase in optimistic derivatives positions, as traders are massively betting on a potential doubling of the price towards €5,600 ($6,500).

In Short #

- On the derivatives exchange Deribit, the most popular Ethereum option is currently a bet on a price rise above $6,500.

- This call option has a ’notional open interest’ of over €326 million, indicating a significant capital commitment.

- This optimism contrasts with recent price movements: Ethereum fell sharply this quarter from its October peak, but is now posting a 9.5% gain today.

Massive Bet on Ethereum Price Increase #

According to data from Deribit Metrics, the call option for Ethereum with a strike price of $6,500 is the most popular. The total value of all open contracts for this option, known as ’notional open interest,’ amounts to over €326 million as of December 3, 2025.

A call option gives the buyer the right, but not the obligation, to purchase an underlying asset like Ethereum at a predetermined price on or before a specific expiration date. Traders use this instrument to speculate on a price increase.

Call options with strike prices ranging from $4,000 to $6,000 are also popular, pointing to broad-based optimism about a potential future price increase.

Contrast with Recent Price Action #

The optimism in the options market stands in stark contrast to Ethereum’s recent decline. The cryptocurrency’s price has fallen 35% this quarter. It was previously noted that the Ethereum price had entered a ‘danger zone.’ Nevertheless, many traders see the recent drop as an opportunity to re-enter the market.

The big question remains: is the worst over and is the market starting a new bull run, or is this merely a temporary relief rally?