Photo: xlup/Shutterstock

While the price of bitcoin has slumped over the past month, large players are seizing their opportunity. They’ve been on a shopping spree, even as billions of euros in losses have rippled through the market. It suggests the pain may be nearing a tipping point, and the charts are now starting to signal that as well.

Whales Seize Opportunity After BTC Drop #

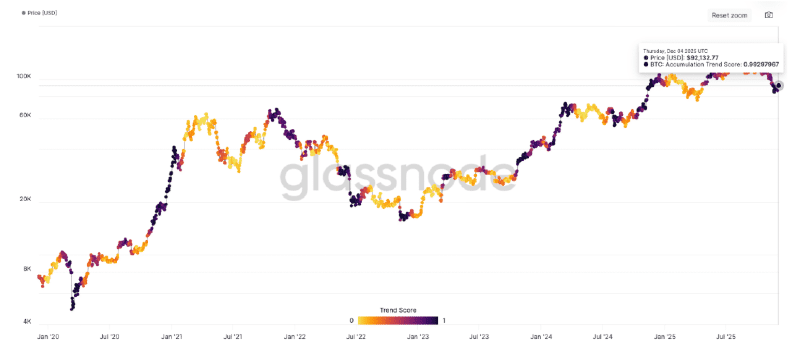

Bitcoin fell back to $80,000 last month, and it was precisely at that point that the biggest players sprang into action. According to analytics firm Glassnode, the so-called accumulation trend score is shooting towards 1, which means large investors are intensely buying rather than selling. The chart is turning dark blue: a signal that whales see the dip as a buying opportunity.

Not only wallets with hundreds or thousands of bitcoins are striking; smaller to medium-sized parties with 10 to 1,000 BTC are also buying on a remarkable scale. This pattern is strongly reminiscent of July, when an identical buying wave eventually fueled the rally towards the record of $124,500 in August.

The buying frenzy is so strong that large addresses are now absorbing almost 240 percent of the annual bitcoin production. This means more bitcoin is disappearing from the market than is being mined daily.

Notably, crypto exchanges cannot keep up with the pace. Their so-called absorption rate has fallen to below -130 percent, meaning historic amounts of bitcoin are being taken into wallets outside of exchanges. This means fewer coins are directly available for sale, which of course is good news for the price.

Especially the group with 100 BTC or more is going hard. They are buying almost one and a half times as much bitcoin as is being spent by miners. According to Glassnode, this is the fastest accumulation tempo ever measured among whales and sharks.

Has Bitcoin Found Its Bottom? #

The other side of the story is the enormous damage among traders. The recent decline caused the largest peak in realized losses since the collapse of crypto exchange FTX in 2022, according to Glassnode.

On November 22, short-term holders (wallets that hold their coins for less than 155 days) recorded a loss of €2.58 billion, while long-term holders (wallets that hold their coins for more than 155 days) had to absorb another €1.53 billion in losses. Together, this totaled €4.11 billion in realized losses.

Glassnode emphasizes that especially recent buyers are under pressure. Long-term investors seem to be weathering the storm relatively well, but they are of course already more accustomed to the fierce price movements of the digital currency. It is often the newcomers who get washed away in large numbers when the price performs poorly.

The mix of significant selling losses and massive purchases by the big players often emerges in periods when a market is seeking its bottom. This is also beginning to become visible in the charts.

The bitcoin price has been moving in an upward trend for weeks despite all the turbulence. Each low is higher than the previous one, and the peaks are also steadily moving upwards. This morning, a new low was formed just below the $90,000 mark.