A Bitcoin trader has made a remarkably precise bet on a price increase for the leading cryptocurrency before the end of the year. The wager? A staggering 20,000 Bitcoin. Does this investor know something the rest of the market doesn’t?

Bitcoin Trader Places Massive Bet #

An investor has made a substantial bet on a Bitcoin rally occurring before December 25, 2025. The prediction is that Bitcoin will see price gains, but will not rise above $118,000. Crypto options exchange Deribit announced the trade on X.

The position was established through three transactions: two of 8,000 Bitcoin and one of 4,000 Bitcoin. These were large-scale orders executed privately between two parties. The investor conducted the trades off the open market to prevent influencing Bitcoin’s price, a method similar to over-the-counter (OTC) trading where large orders are kept off the order books to maintain price stability.

What Did He Do? #

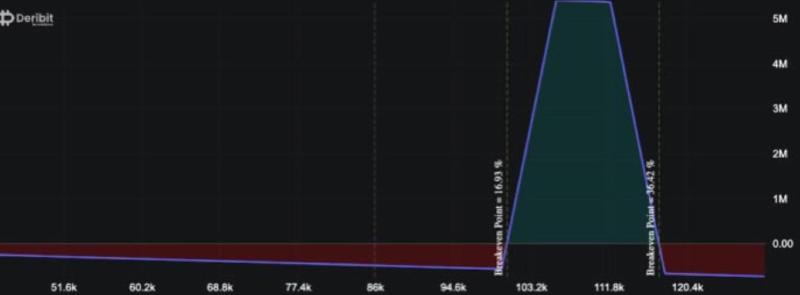

The trader utilized what is known as a “call condor”: an options strategy involving four contracts, all expiring on December 25, 2025, but each with a different strike price. This approach allows him to bet on a Bitcoin price increase, but within a specific range.

With this structure, the investor profits if Bitcoin is trading between $100,000 and $118,000 at the expiration date. The maximum profit is achieved if the price ends up around the $106,000 to $112,000 range. If Bitcoin’s price is lower, the trader loses the initial premium paid. If the price surges significantly higher, the profit potential flattens.

What Is He Hoping to Achieve? #

The trader appears to believe that Bitcoin will experience a rally before the end of the year, but that the all-time high has already been reached. By placing this specific bet, he can profit more if the price recovers without shooting to a new record high.

At the very least, the position suggests the trader believes we are not yet in a bear market, even though there are signals pointing in that direction.