Falling Crypto Prices, but Platform Offers a Solution #

A highly requested feature is finally available in the Netherlands: as of today, users of OKX can start using spot margin trading.

This allows them not only to use up to 10x leverage in their trades but also to trade during crypto price drops—a capability that has been absent from most Dutch apps until now.

Betting on Price Drops: Now Possible #

The crypto market is indecisive, and altcoins, in particular, have shown significant movements in recent days. Many Dutch and Belgian traders want the ability to switch gears in such periods: profiting from both rises and seeking protection during falls. Spot margin now makes this possible.

With spot margin, you temporarily borrow crypto or stablecoins to open larger positions. You continue trading on the regular spot market, but with more firepower. For example, if you believe Ethereum’s price will fall, you can now sell it via margin—even if you don’t own the coin.

If the price indeed drops, you can buy it back cheaper and keep the difference.

One of the Most Requested Features #

Among Dutch crypto investors, margin trading has been a long-standing wish. While international platforms have long offered the feature, many European apps lagged behind due to legal and regulatory constraints. OKX is now changing that. Users can leverage their capital up to 10x.

Furthermore, spot margin works with real coins: you buy, borrow, or sell the underlying crypto, without synthetic contracts. Interest on borrowed amounts is calculated hourly, and positions can be closed at any time.

How to Find the New Feature #

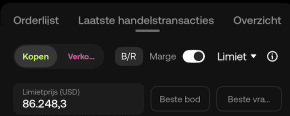

The ‘margin’ feature is available to all Dutch and Belgian users with an OKX account. Ensure your account is set to ‘Exchange’ mode, which you can switch at the top of your screen. Margin is currently only available for trading pairs with USD or USDC.

Here’s how to activate it:

- Select a USD trading pair, such as BTC/USD.

- A toggle labeled ‘Margin’ will appear in the top right.

- Turn on the toggle to activate margin trading.

Note: always read carefully about how margin trading works and what conditions apply. It offers extra flexibility, but also comes with risks.