Photo: PJ McDonnell/Shutterstock

Michael Saylor, the executive chairman of Strategy, has shared his latest bitcoin purchase in a post on X. The move is notable, coming shortly after controversy surrounding his purchase of a private jet.

The Bitcoin Purchase #

In his post, Michael Saylor announced that Strategy acquired 10,624 bitcoin for $962.7 million. The average purchase price per coin was approximately $90,615. This brings the year-to-date yield on the company’s bitcoin holdings to 24.7 percent.

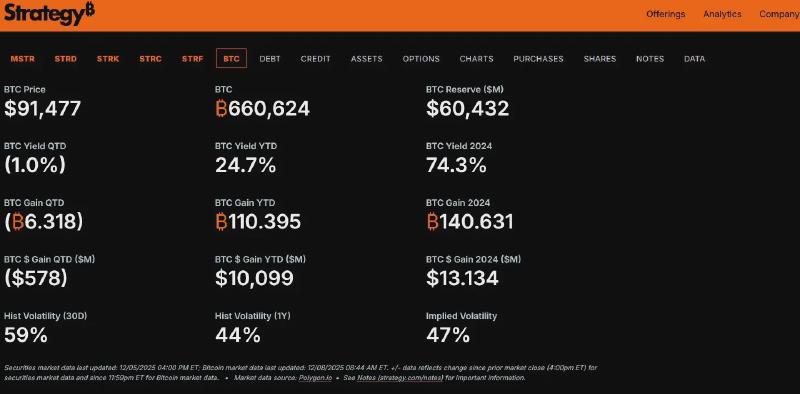

Strategy now holds a total of 660,624 bitcoin in its portfolio. The company has purchased these holdings for a total of $49.35 billion, at an average price of $74,696 per bitcoin.

This latest acquisition ranks as the 24th largest in the company’s history.

Is This a Relatively Large Purchase for Strategy? #

While Strategy has made much larger purchases in the past, the company had recently appeared to become more cautious:

Three weeks ago, Strategy made a large purchase of over 8,000 bitcoin, but such significant buys had become rarer. This is not entirely surprising given the high price of bitcoin. For instance, purchases slowed considerably around the bitcoin price record of October 7, 2025.

While this is the second-largest purchase in the dataset shown (which runs until May 2025), Strategy has made much larger acquisitions, as detailed on its website.

Strategy’s Biggest Purchases #

By far the largest bitcoin purchases by Strategy occurred in late 2024. On November 18, 2024, the company bought 51,780 bitcoin, and a week later, it added another 55,500.

Other major purchases include 29,646 bitcoin on December 21, 2020, 27,200 bitcoin on November 11, 2024, and 22,048 bitcoin on March 24, 2025.

Strategy’s Statistics #

Looking at Strategy’s statistics regarding bitcoin, the company has purchased approximately 110,000 bitcoin this year. Last year, that figure was 140,000 bitcoin. The yield for this year remains strong, at nearly 25 percent, and the bitcoin purchased last year are up nearly 75 percent:

Other figures from Strategy’s website show mixed results. The MSTR stock is down 54 percent over the past year, and the company’s market capitalization is now below the total value of its bitcoin holdings. Those who bought STRD are still at a small loss of a few percent. STRK and STRC are showing a 13 percent profit, while STRF has a 35 percent gain.