Terra Classic Surges 160%: What’s Behind the Comeback? #

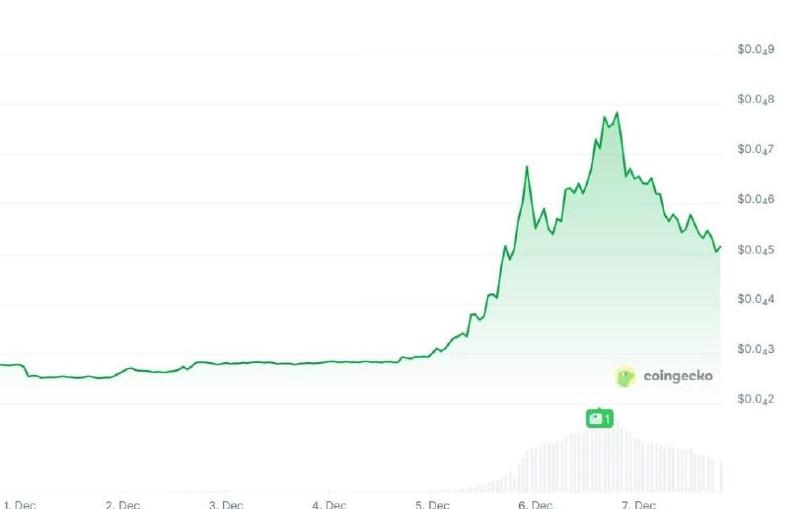

Terra is suddenly back in the crypto spotlight. In just one week, the project’s token, LUNC, has soared by a staggering 160 percent. This price explosion is drawing many crypto traders back to the project. Despite its turbulent history, Terra might be staging a comeback, fueled by legal developments and technical changes. What’s happening behind the scenes?

Renewed Attention from Lawsuit #

The resurgence coincides precisely with the approaching verdict in the case against founder Do Kwon on December 11. Many investors hope that a final judgment will finally bring clarity to the project, which has been under a dark cloud since the collapse of the Terra ecosystem.

At the same time, technical factors are playing a significant role. The amount of LUNC tokens burned has risen sharply in the past week, with 849 million coins destroyed. These are so-called ’token burns'.

Token burns reduce the total supply, which can create scarcity over the long term. Binance is a key player here, as the crypto exchange automatically burns half of the trading fees.

However, the total amount of burned tokens remains small compared to the circulating supply of 5.49 trillion. Nevertheless, the upswing is generating new enthusiasm within the Terra community.

The temporary pause on LUNC withdrawals on Binance also contributed to the increased trading activity. This suspension was implemented in preparation for a network upgrade designed to resolve stability issues.

Reminders of the Biggest Crypto Crash Ever #

The new rally once again puts the focus on the dramatic events of 2022, when the Terra ecosystem collapsed. The stablecoin UST lost its peg to the dollar, after which both UST and LUNA became virtually worthless. Within a short period, over forty billion dollars in market value evaporated.

According to prosecutor Daniel Gitner, it is one of the biggest crypto disasters ever, with potentially more than a million victims worldwide. Because transactions were spread across international exchanges and anonymous wallets, it is difficult to reach those affected.

The fall of Terra caused a chain reaction that also brought down large companies like Three Arrows Capital and Celsius. Founder Do Kwon was arrested in 2023 and later extradited to the United States.

The recent price jump shows that a part of the market still sees opportunities, but the risk remains high. The coming weeks, with the verdict in sight, will be decisive for the further fate of Terra Classic.