In the past week, the tokens of the Terra Luna ecosystem have once again captured significant attention. This surge has not gone unnoticed in the Netherlands, where investors are buying up these tokens en masse. Terra Luna Classic (LUNC) has even become one of the top 5 most sold tokens on the Bitvavo exchange. So, what is behind this sudden resurgence of interest?

Terra and Terra Luna Price Action #

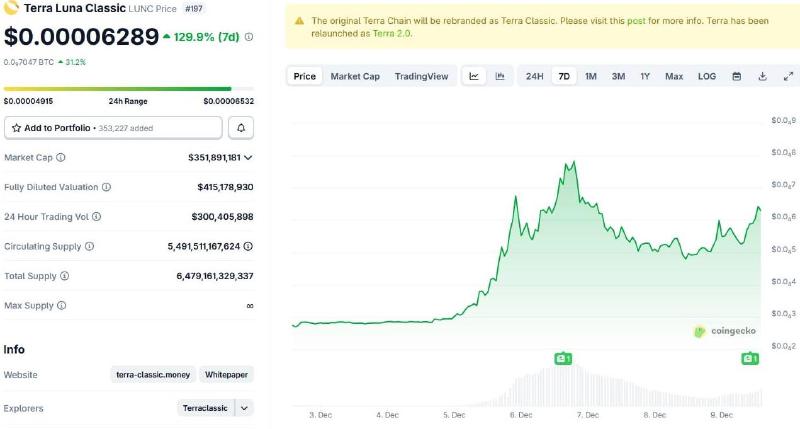

LUNC Price #

The price of Terra Luna Classic has surged by 130% over the past week:

The token began its rally on December 4, peaking on December 6. After a slight dip, it made a strong comeback today with a daily gain of 25-30%. Trading volumes have also exploded, rising from $10 million on December 4 to $300 million now.

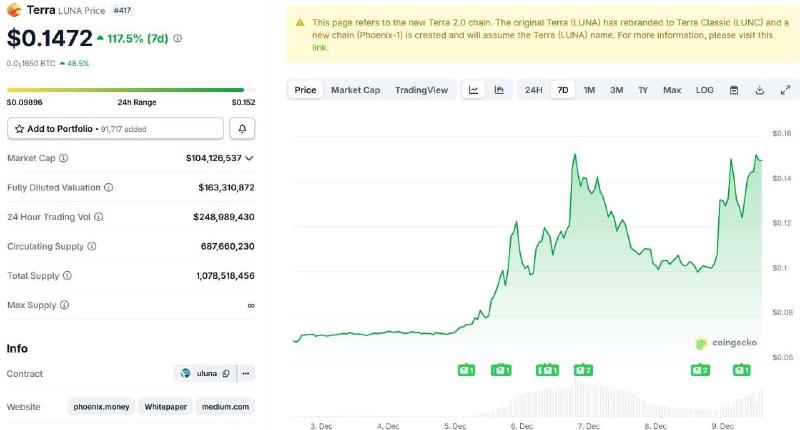

Terra (LUNA) Price #

The price of the new Terra token has also climbed by nearly 120% in the last week:

This token also started its upward trend on December 4 and hit a weekly high on December 6. The difference is that it recovered more strongly today after a drop on December 7. It posted a gain of around 45% today. Like LUNC, this token is also being traded in much larger volumes than at the start of the week.

What Are These Tokens? #

Terra Luna Classic is the token from the original crypto platform that collapsed in 2022. The Terra Luna ecosystem was built on an algorithmic relationship between the platform’s stablecoin (UST) and its native token. A flaw in this mechanism caused the stablecoin to lose its peg, which in turn forced the minting of massive amounts of the native token. This feedback loop caused both tokens to lose almost all their value, leading to a total collapse of the house of cards and erasing billions in value during the last bull market.

Terra is the new token from this reformed platform, which wisely abandoned the algorithmic stablecoin model. It is a native staking and governance token managed by the community, which has severed ties with Terraform Labs, the company behind the original Terra blockchain.

Why Are These Prices Rising? #

The price surge for these tokens appears to be centered around the network upgrade scheduled for December 8. The ongoing legal proceedings against Do Kwon, the founder of the original Terra, have also been cited as a factor. Additionally, a large quantity of tokens was taken out of circulation last week, creating more scarcity, which could also be contributing to the price increases.

Analysts suggest this could be a “buy the rumor, sell the news” event, where investors position themselves ahead of the upgrade and sell after it occurs. Expectations are for high volumes and volatility to continue for some time.