December has kicked off with a jolt for crypto investors. Bitcoin slid more than 5% in a short period, once again tapping the $86,000 zone this morning. The move immediately put pressure on the rest of the market, with major altcoins painting deep red. In total, around $160 billion (nearly €140 billion) in value evaporated from the crypto market within a day. Additionally, €471 million worth of long positions were wiped out in the last twelve hours. Crypto traders are now asking: what’s behind this drop, and what’s next for the market?

Photo: Artit Wongpradu/Shutterstock

Bitcoin Crashes 7% #

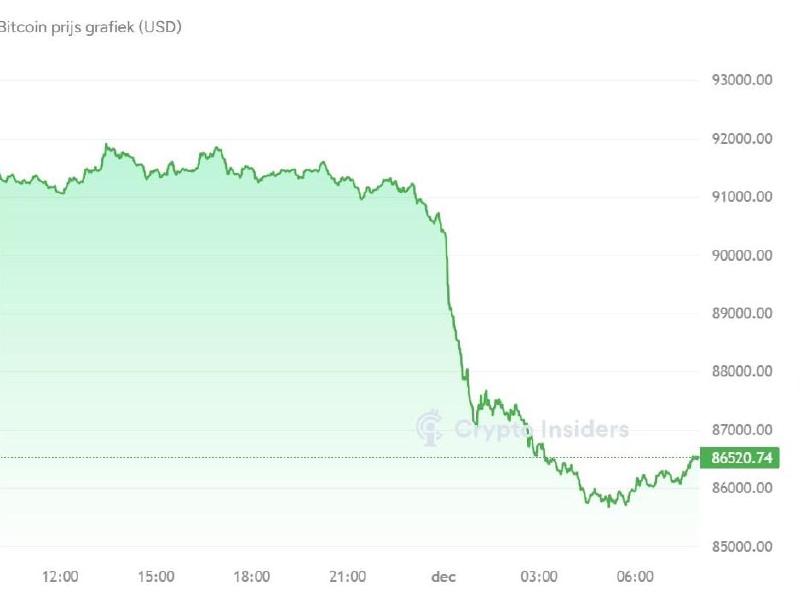

Bitcoin was hovering around $91,000 just days ago, but suddenly dropped towards $85,800 overnight. This move completely wiped out last week’s recovery in one go. The price action fuels fears that the current support zone may not hold for much longer. The price is currently moving back above $86,000.

Bitcoin price over the last 24 hours.

Meanwhile, data shows that investor sentiment is divided. According to a Myriad poll, 73% of participants still expect bitcoin to head towards $100,000. The rest, however, see a higher probability of a fall back to the $69,000 region. Mudrex analyst Akshat Siddhant commented:

If sentiment stabilizes, bitcoin could make another attempt upwards. For now, $85,000 remains an important support, with the first resistance around $92,400.

Macro-Economic Turmoil Hits Crypto Market #

Macro-economic factors play an enormous role in the crypto market these days, as Unocoin CEO Sathvik Vishwanath noted just a few days ago. He stated that the market is highly sensitive to economic data and interest rate expectations, where a single surprise can have a major impact on the entire market.

We are now seeing macro-economic factors causing tension again. Tonight, U.S. Federal Reserve Chair Jerome Powell is set to speak. Expectations for a rate cut have increased in recent days. Traders are awaiting his speech to determine their next moves.

Factors from Asia are also at play. The U.S. market is attracting global capital, and Japan has hinted at higher interest rates, which could lead to the unwinding of the well-known yen carry trades. Such shifts often send shockwaves through risky markets.

At the same time, signals from Asia are further pressuring sentiment. China’s central bank reiterated its hardline stance against crypto and announced it would increase its oversight of stablecoins. “The market atmosphere remains mainly driven by fear,” said a member of the CoinDCX research team.