Crypto Token Crashes 40% After Massive Rally – Here’s What Happened #

Fast risers can also be fast fallers. That was proven once again when the price of XION collapsed by 40%. Yesterday, the token was still up 300%, following speculation about its addition to a new exchange. When that happened, speculators exited the market en masse in a classic case of ‘buy the rumour, sell the news’. Read more below.

300% Up, 40% Down #

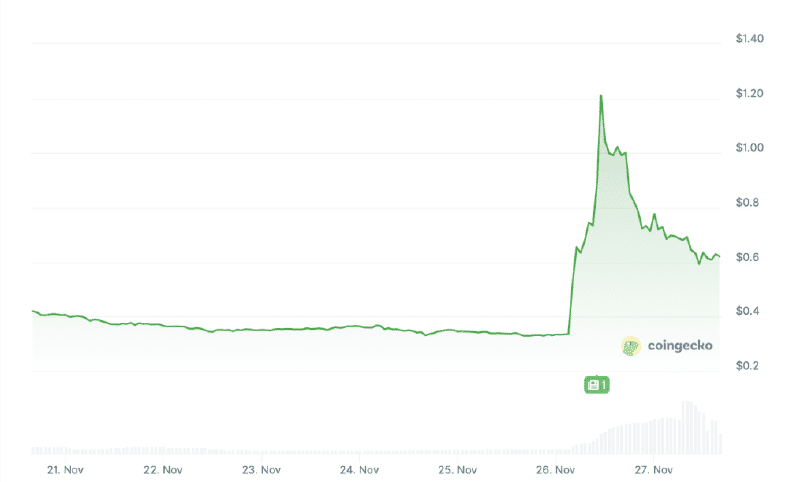

Yesterday, the price of XION skyrocketed from $0.335 to $1.21 in one day—a rise of over 300%. The trigger was an announcement that the South Korean exchange Bithumb would add XION to its trading offerings.

Because being listed on an exchange expands the market, speculators piled into the token to bet on future price increases. As a result, the price of XION had already risen significantly before the addition to Bithumb.

However, once the token was listed on the exchange, XION did not rise further; instead, the price crashed. It has since fallen by 40% from its peak, erasing most of yesterday’s gains. Although the token is still trading at double its pre-surge level, it now hovers around $0.63 per token.

Buy the Rumour, Sell the News #

This appears to be a classic case of ‘buy the rumour, sell the news’. In this scenario, speculators buy in advance based on positive news that hints at future price increases, but they exit as soon as it becomes reality. After all, they are not long-term investors.

The expected price increase therefore happens before the anticipated event, often resulting in a crash on the day itself instead of a rise. This is partly reinforced because it is a well-known dynamic. Sometimes the crash even happens in advance, as traders try to exit earlier than the rest.

Key Levels #

Once all speculators have exited the market, the price can recover. Then, it will have to be seen whether there is enough real demand left for a new price increase. According to analyst Jack, it is especially important that the price stays above $0.62 and preferably reclaims $0.69 or even $0.79. He writes:

“Listings can cause rallies, but the structure determines the future. Watch the key levels: if the bulls reclaim them, this chart will quickly write a new chapter.”