Crypto investors had long awaited the arrival of an XRP ETF in the United States. In early November, Canary Capital had the honor of launching the very first spot XRP ETF, which was met with great success.

Now that the XRP exchange-traded fund finally exists, an important question arises: how does it compare to bitcoin and ethereum? These cryptocurrencies have been benefiting from their own ETF products for longer. The initial figures show a striking difference between the strong interest in XRP ETFs and the volatile price performance of the cryptocurrency itself. What is going on?

Bitcoin and Ethereum Set the Tone #

When the U.S. regulator approved Bitcoin ETFs in early 2024, the crypto market first went into a panic. The BTC price fell from $48,000 to below $40,000. This was a classic example of a ‘sell-the-news’ moment. However, bitcoin recovered quickly, reaching a new record of over $73,000 within two months.

This recovery was primarily driven by strong inflows into the ETFs. Inflows mean that investors are putting money into a fund, which increases demand for the underlying asset.

BlackRock’s IBIT, in particular, became a huge success. The total net inflow into Bitcoin ETFs has now surpassed $57 billion, and BTC is trading at almost double its price on the first trading day.

Ethereum had a more difficult start. After its launch in July 2024, ETH fell from $3,600 to $2,200. For a long time, demand for Ethereum funds lagged, and there was little inflow.

It wasn’t until towards the end of the year that sentiment turned and the price climbed back above $4,000. Nevertheless, the ethereum price today is lower than it was at the launch of its exchange-traded fund.

XRP ETF Has Strong Start, But Price Remains Weak #

On November 13, the first fully XRP-based ETF launched. Canary Capital’s fund immediately broke the 2025 trading record and was followed by three new products. The total inflow now stands at nearly $900 million. Notably, there has not been a single day where outflows exceeded inflows.

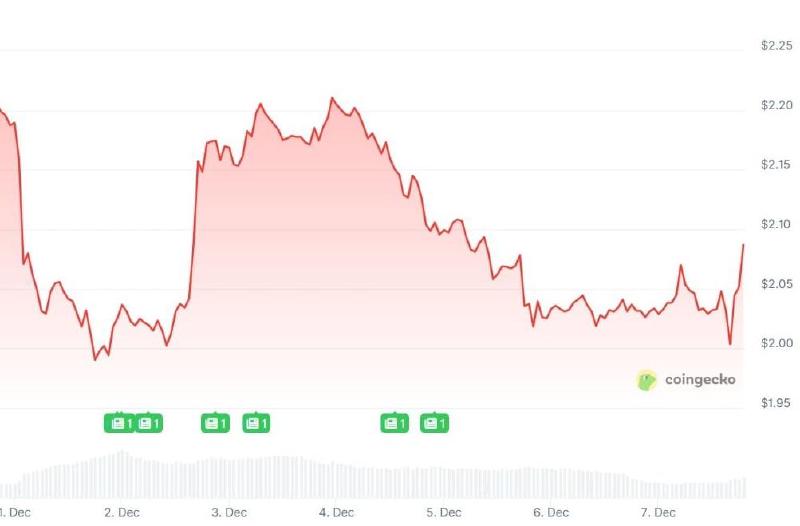

Yet, the price is struggling. After the ETF introduction, XRP fell from $2.50 to $2.30 and is now trading around $2.03. The sentiment is not helping. Market researcher Santiment observes that the sentiment around XRP on social media is at a low point. This means there are few positive sounds surrounding the token from crypto company Ripple.

The ETFs show clear interest in XRP, even while the price lags behind. But there is also positive news. When inflows, sentiment, and fundamental growth converge, XRP may still make a strong comeback.