XRP Signals Rebound, But Buyers Stay on the Sidelines

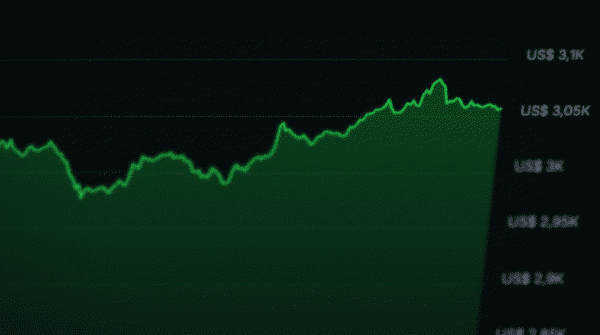

Despite signals on the derivatives market that typically precede a rebound, XRP is struggling to attract buyers. The price dipped below $2, and both open interest and on-chain activity remain low, indicating a lack of confidence.