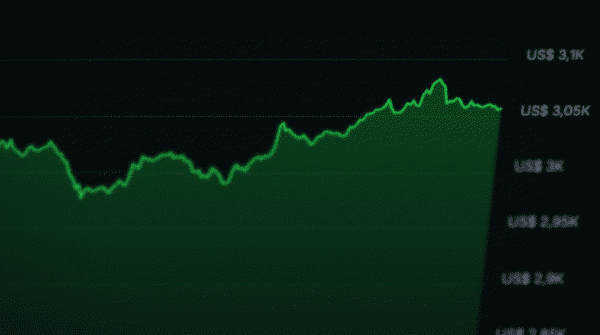

Ethereum Launches Historic 'Fusaka' Update, Price Jumps 4.5%

Ethereum has successfully deployed the long-awaited Fusaka upgrade, a major network enhancement focused on scaling and efficiency. The price of ETH responded immediately, climbing over 4% as the upgrade went live.