US Central Bank's Major Error Poses Risk to Bitcoin

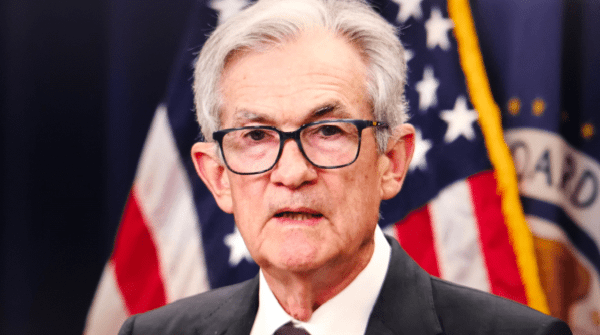

Federal Reserve Governor Stephen Miran warns the central bank is fighting the wrong battle by focusing on outdated inflation data, while the real risks are economic cooling and job losses. A potential policy shift towards rate cuts in response to these risks could create a favorable environment for Bitcoin.