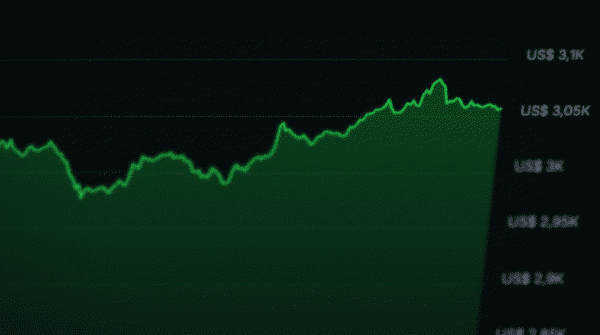

Tipping Point for XRP, 'Ugly' Year-End Looms If This Price Doesn't Hold

A crypto analyst has identified a technical pattern suggesting a potential trend reversal for XRP. The price is at a critical juncture, with a break above $2.22 potentially triggering a rise to $2.50, while a fall below $2.00 could lead to a significant downturn by year’s end.